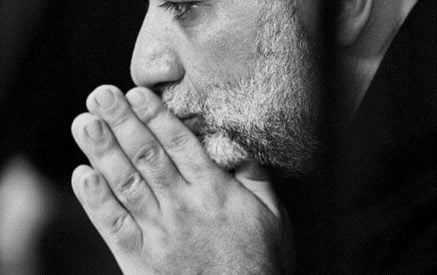

-Mr. Sukiasyan, how was the ending year of 2011 for the banking sector of Armenia?

– First, I have to mention that consequences of the global economic crises are not yet completely overcome, moreover, they speak about the possibility of the second wave of crisis; these processes, of course cannot be without consequences for our economy and, in particular for the banking sector.

Our local, negative factors should also be added. First of all I would mentioned the large -scale emigration, which narrows the commercial-economic base and contributes to “brain drain”; I must also add the corruption, heavy situation of small and medium business and so on.

Read also

In short, positive changes in the real sector of economy are not observed. And in this situation expecting high results from the banking sector of Armenia would not be fair. However, due to the efforts of our commercial banks the banking services and products also have increased in this year and their quality raised.

– One can agree that the banks of our country develop fast; they are also reliable for our population. But the percent rates of bank loans remain rather high, which in its turn negatively affects the country’s economic development.

– It has been repeatedly spoken about the reasons of being “expensive” of loans; I will try to explain this issue once again, in very comprehensible way. Most of the loan resources are provided to us by international financial organizations that calculate the percentage of crediting according to tens of criteria; they being the country’s financial-economic rating, the situation in the region, involvement into the conflicts, level of corruption, index of the country’s development and so on. And the percentage rates are defined according to arising risks. The Armenian banks have to take into account all the risks in order to be able to perform their obligations to those crediting organizations and to their own depositors. Hence, the high loan percentage arises.

Of course, we are fully aware that the “expensive” money offered to businessmen do not support the country’s dynamic development, on the other hand, they bear new risks relating to repayments of loans. I think it’s clear that banks are also interested in cheaper loans.

– Besides the long-term factors mentioned by you, which factor can affect making the crediting cheaper?

– There are a lot of such factors; perhaps I would mention one important factor out of them. Yes, the trust of the population towards banks is growing, but still there are big amounts of money in the hands of the people that are kept “under the pillow” as they say. If those amounts start working in the banking sector, then I am sure that it would also help making the loans cheaper.

After all, people should understand that the banking system is stable, the deposits are guaranteed by the state, keeping money at home contains more risks.

Taking this opportunity I would like congratulate our people on Happy New Year and Merry Christmas festivities and wish them good luck, success and respectable mode of life.