- GDP growth slowed to 2.2 percent in the first quarter of 2015.

- Monetary policy remains tight with high food prices pushing headline inflation closer to the upper bound of the CBA’s target of 4±1.5 percent.

- Tax revenues posted moderate growth while increases in allocations for social programs may put pressure on spending.

- The trade deficit narrowed in the face of plunging imports and declining exports.

- Net remittances declined by 44 percent in January-April 2015

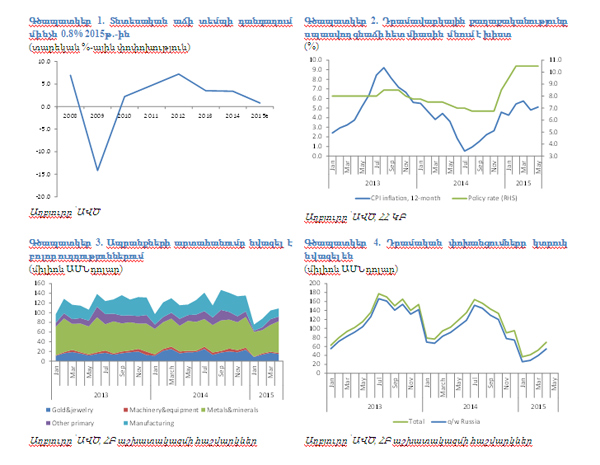

Recent economic developments confirm a low-growth environment for 2015 as a whole. Economic growth in the first quarter of 2015 was 2.2 percent. A cumulative index of economic activity (i.e. for January-February, January-March, etc.) has been fluctuating between 2.5-2.7 percent (year-on-year) since February, while it historically tends to pick up as the year progresses. Agriculture drove growth during the first five months of 2015, reflecting good harvest of apricots. The demand side of GDP remains constrained as a reflection of reduced trade and remittances from Russia. This is manifested in a protracted and deepening decline of retail trade – 8.6 percent in January-May of 2015 (year-on-year).

Monetary policy remains tight. In May the Central Bank of Armenia (CBA) refrained from open market interventions and bought foreign exchange in amount of US$30 million over June 8-26. This will contribute to a build-up of international reserves and help mitigate seasonal appreciation pressures on the exchange rate. The stock of loans in April of 2015 declined by 3.5 percent as compared to end-December of 2014 with FX-denominated loans suffering the largest contraction. Commercial banks deposited excess FX-denominated liquidity at the CBA, which contributed to an increase in gross reserves by US$102.9 million in May (month-on-month). This also revealed expectations of exchange rate depreciation manifested in an unwillingness of commercial banks to lend in local currency and of businesses to borrow in foreign exchange. The policy rate remains at 10.5 percent, contributing to a high cost of borrowing.

A good agricultural harvest is yet to translate into lower food prices, the major driver of inflation in May. The inflation rate reached 5.1 percent in May (year-on-year), approaching the upper bound of the CBA’s target of 4±1.5 percent. The major driver of inflation was food prices, which grew by 5.1 percent in April (year-on-year) and contributed 2.5 percentage points to overall inflation. Non-food products and services contributed 1.1 and 1.2 percentage points, respectively. Inflationary pressures may increase in the second half of the year, if electricity tariff increases by 16.6 percent as per the recent decision of the Public Services Regulatory Commission.[1] Armenian authorities requested independent audit of the Electric Networks of Armenia to review financial statements of the company and decide of the justified level of electricity tariff. Final decision of the tariff and settlement of accounts of the ENA will be done after the audit and by then the proposed increased will be funded from the budget.

Fiscal space remains constrained reflecting moderate growth of tax revenues and pressures on spending. Tax revenues grew by 1.3 percent in January-May 2015 (year-on-year). In this period indirect taxes contributed only 0.1 percentage point to the increase of total tax revenues, reflecting weak growth of the domestic economy and subdued imports. To mitigate the adverse impact of the possible electricity tariff increase on poor households, on June 25th 2015 the Government approved amendments to the decree on the family benefit size, increasing it from AMD17000 to AMD19000. If the new tariff becomes effective as of August 1st 2015, allocations for the family benefit program should be increased by AMD1.05 million for 2015 (additional AMD2000 for 5 months for 105,000 beneficiary families). However, actual burden on fiscal accounts (including higher allocations for the family benefit program) will be estimated after the audit of the ENA. To create some fiscal space for expansionary policy and allow not to breach the debt threshold of 50 percent of GDP in 2015, the Law “On Public Debt” was amended on June 23rd to apply the fiscal rules only to government debt, excluding CBA’s debt, which amounts to 3.7 percent of GDP, and as a result the fiscal deficit in 2016 can be more than 3 percent of average GDP of 2013-2015.[2] This, however, is a precautionary measure rather than an inevitable choice as the fiscal deficit was constantly under-executed and remained below 2 percent of GDP over last three years.

Read also

The trade deficit halved in January-May of 2015 (year-on-year) to US$581.6 million. The improvement of in the trade balance was driven by a plunge in imports by 38.0 percent, as exports declined by 15.2 percent contributing to a widening of the trade balance. While detailed external trade statistics for January-May 2015 are not yet available, the pattern is consistent with the one observed in January-April, with weaker demand from Russia and the EU a major underlying factor. Due to difficult implementation of EEU customs procedures, and, in part, to the relative appreciation of the dram vis-à-vis the Russian ruble and weak economic performance in EEU partners, in January-April 2015 exports to the EEU stood at 3.6 percent of the level registered in January-April of 2014. Exports to the EU declined by 6.9 percent. A slowing economy and declining remittances from Russia compressed import demand. Net remittances declined by 44 percent during January-April of 2015 (year-on-year), fully driven by a 52 percent decline of net remittances from Russia.

[1] On June 17th the Public Services Regulatory Commission issued a decision to increase the electricity tariff from AMD41.85 to AMD48.78 per kWh to cover accrued losses of the Electric Networks of Armenia (ENA) in the amount of US$225 million. Even though the increase is substantially lower than the one proposed by the ENA (by AMD17), it triggered protests, as the public widely considers the losses to be caused by mismanagement of the company.

[2] Currently the Law “On Public Debt” specifies two fiscal rules. The first rule says that the public debt (defined as a sum of government’s and CBA’s debt) should not exceed 60 percent of previous year’s GDP. According to the second fiscal rule, if in a particular year public debt exceeds 50 percent of previous year’s GDP, then next year’s fiscal deficit should not exceed 3 percent of GDP of previous 3 years.