Furnished with modern equipment, the State Revenue Committee’s Monitoring Center started today its operations. The official opening ceremony was attended by Prime Minister Karen Karapetyan.

Equipped with a state-of-the-art electronic control system, the tax and customs monitoring center is supposed to improve and upgrade the process of identification and risk analysis carried out in the SRC. The center will implement expanded and centralized analysis, monitoring of turnover declarations, payment processing and products, import, transport and so on.

Operational under the government’s 2017 program and priorities, as well as under the program of improved tax administration, the monitoring center will replace the applicable inspection activities with electronic surveillance system.

In accordance with the initiative and SRC Chairman’s executive order, there were set up cash registers and accounting documents in transaction monitoring and criteria for risk assessment of the notification procedure for taxpayers. Based on the above, monitoring and analysis shall be carried out over cash register-operated fiscal turnover, transactions and prices and the discharge of computing documents.

Read also

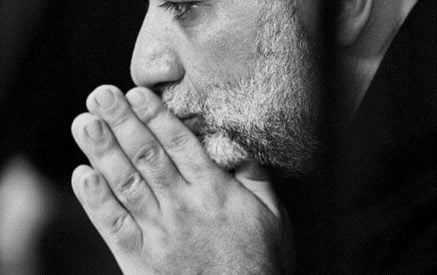

The center shall minimize the risks arising from taxpayers’ undocumented transactions, turnover and price understatement. Due to centralized analysis of basic activities of taxpayers and specific indicators, the monitoring center will be a key link in the quick identification of risks and responsiveness. Addressing news reporters, the Prime Minister highlighted the establishment of the center. In particular, he noted that the SRC has been set the task to create a system in which law-abiding white-field taxpayers might feel comfortable, while black-listed entities would be kept under strict control.

“We are definitely going to achieve this target. In order to exercise that kind of control, we need to have smart management in addition to providing fair and equal conditions. The SRC should not unnecessarily disturb the taxpayer and the businessman. This system digitizes the subject of management and the indicators established by managers will immediately expose the risky transactions and entities. Therefore, reference information can be obtained while making a choice on where to carry out checks. The given system shows that, for example, at 1: 30 AM a cash register-operated transaction or quite a large volume of transactions were made: it is obvious that there is a risk here. In this case, the SRC will soon be able to explore, understand what is sold wholesale or retail purchase is made. Therefore, we expect that the checks and controls will be much more targeted and effective, and there will be less trouble for businessmen,” Karen Karapetyan said.

The Prime Minister said that the SRC collected AMD 16 billion more in January-February than in the same period last year. “It is quite a serious figure. We have formulated a clear recommendation for the SRC, which implies that all the proposed targets are to be complied with. But there are such standing rules as should not be broken, for instance the SRC must refrain from demanding down payments so that business people might not face artificial problems. In this sense, this system is extremely important. At the same time, advance payments have always been topical while talking about major taxpayers. Evoking the aforementioned 16 billion in extra revenue, I would like to draw your attention on its content. The SRC is minimizing the balance of down payments that is the SRC database now contains many entries that were unavailable previously. Besides, the qualitative aspect is what matters most concerning the above-stated 10.9 percent rise in revenue. Large companies are wearing down the balance of advance payments. In that sense, we are going to have much higher growth in tax revenue,” the Prime Minister said, stressing that the SRC is implementing fundamental reforms, and the opening of this center is first step on that way.

Karen Karapetyan said that in the near future the SRC will submit the whole package of reforms. “I am confident that we will get the result of these efforts. White-listed and law-abiding entities will be spared unnecessary trouble. While we boast obvious progress in the system, there will always be room to improve it. We will never reach the point to say that we do not have more to do. I think that the situation has changed. The SRC has a feedback supported by my staff and the people who are involved in the Committee’s work. In cooperation with the SRC staff, we have responded to all complaints concerning the system. As I have long been keeping in close touch with the representatives of major businesses, I can state that we have now fewer complaints than before.”

Coming to the fight against the black economy, the Premier said that the SRC and all the other partners have been set the task of increasing management efficiency and implementing smart management.

“Our analysis has shown that the rate of profitability is different in the field of exports and domestic business. Exports profitability is lower, while it seems that things should stand otherwise. We think the reason is behind the shadow in the domestic industry, including the dominant status, which leads to high profit rates. This toolkit, this center allows us to assess the risks and check the internal market more easily. We need to ensure that all retail outlets have cash registers, and each citizen understands the use of working with cash-registers. We are very clearly going in that direction,” Karen Karapetyan concluded.