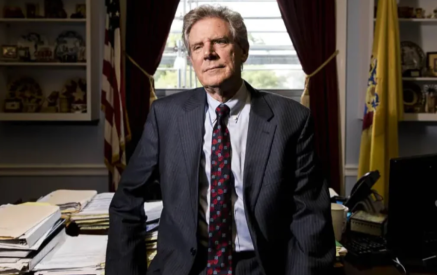

Rep. Judy Chu (D-CA) has once again called on the U.S. Department of Treasury to begin negotiations with Armenia on a modern Double Tax Treaty, a longstanding Armenian National Committee of America (ANCA) public policy priority that would promote job creation and expand bilateral trade between the two countries.

“We value Congresswoman Chu’s continued leadership in support of a modern U.S.-Armenia Double Tax Treaty and look forward to continuing our work with her and her Congressional colleagues in removing artificial barriers hindering the expansion of bilateral trade and investment – in IT, tourism, agriculture, and other growth sectors,” stated ANCA Government Affairs Director Raffi Karakashian. “To capitalize on the Trade and Investment Framework Agreement (TIFA) signed in 2015 and the recent wave of new U.S. investments, this treaty needs to be put in place as soon as possible.”

In her letter to Treasury Secretary Steven Mnuchin, Rep. Chu noted that “our only existing agreement with Armenia governing tax issues is the 1973 treaty we signed with the now extinct Soviet Union. This outdated accord – negotiated between hostile powers – is clearly insufficient to meet the modern-day requirements of our bilateral relationship.” Rep. Chu had issued a similar call in February, 2016, to former Treasury Secretary Lew following meetings with ANCA leaders during an advocacy “fly-in”.

Congresswoman Judy Chu represents the 27th Congressional District, which includes Pasadena and the west San Gabriel Valley of southern California. She has been a staunch supporter of the Armenian American community since she was elected in 2009 and has co-authored the annual Armenian Genocide resolutions as well as a number of other pieces of ANCA-backed federal legislation.

A U.S.-Armenia Double Tax Treaty would establish a clear legal framework for investors and individuals that have business activities in both jurisdictions, preventing double taxation and facilitating the expansion of economic relations. It would also help reinforce the friendship of the American and Armenian peoples, anchoring Armenia to the West, and providing Yerevan with greater strategic options and independence in dealing with regional powers.

While investors have found ways to adjust to the inadequacies of the outdated 1973 accord, which is recognized by the U.S. but not Armenia, the existing system of foreign tax credits and deductions is not consistent with any accepted tax or accounting system. The U.S. has Double Tax Treaties with many small countries, including Estonia, Jamaica, Latvia, Lithuania, Malta, and Slovenia. Armenia has Double Tax Treaties with many advanced countries, including Austria, Belgium, Canada, China, France, Italy, the Netherlands, Poland, Russia, and the United Kingdom.

The latest ANCA fact sheet about the benefits of an updated U.S.-Armenia Double Tax treaty.

A two-page ANCA fact sheet on a U.S-Armenia Double Tax Treaty can be found at this link: https://anca.org/assets/pdf/ANCA_Double_Tax_Treaty.pdf