EBRD economies suffer recession in second half of 2022

, EBRD trims its regional growth forecast for 2023 down to 2.2 per cent

· Inflation in double digits in more than three-quarters of the EBRD economies

· The Bank expects Armenia’s growth to moderate to 5 per cent in 2023 and 2024

Read also

Inflation, stoked by high gas prices, as well as tighter financing conditions are slowing growth in emerging Europe and beyond, the European Bank for Reconstruction and Development (EBRD) reports today in its latest Regional Economic Prospects forecast.

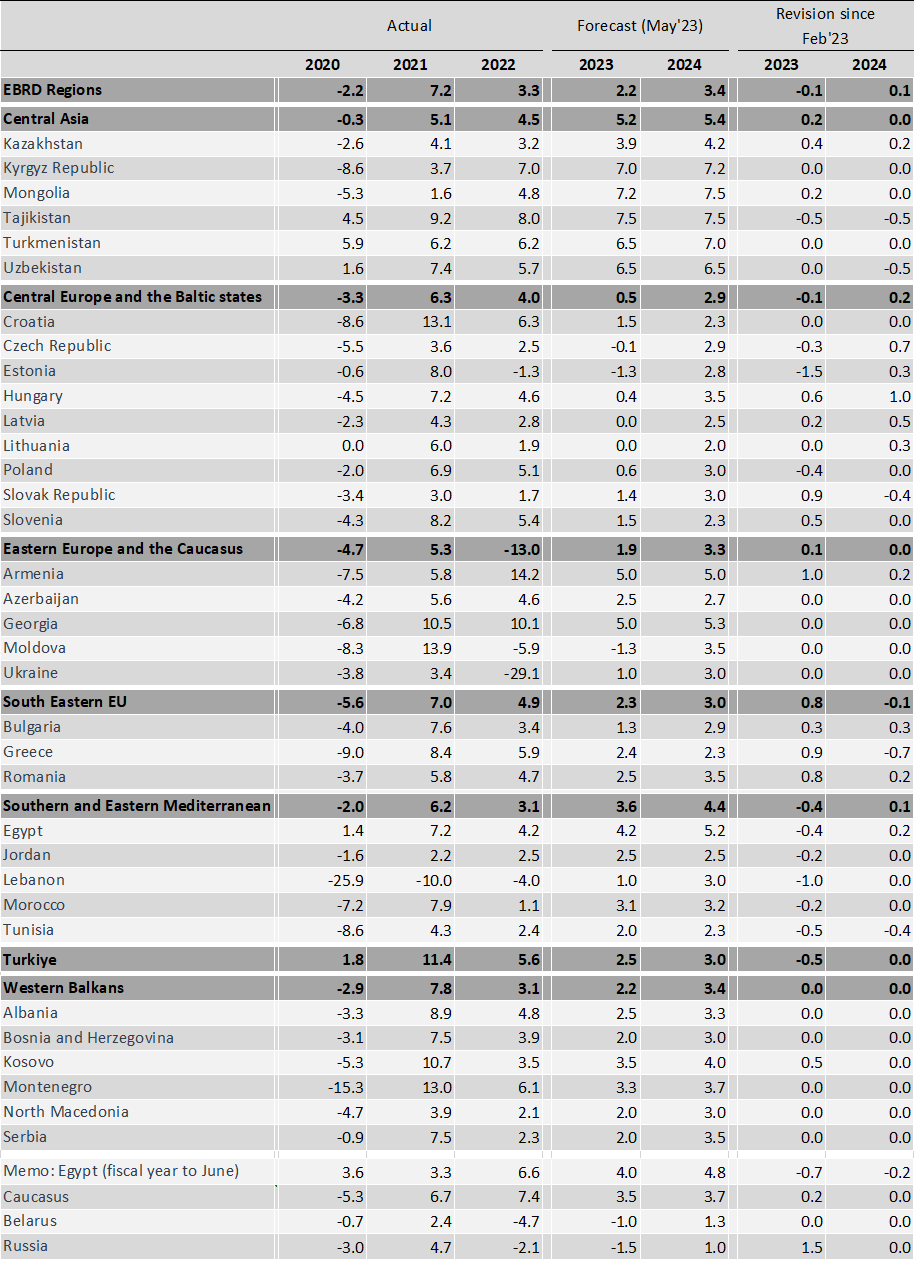

Output in the Bank’s regions, which extend across three continents, is now forecast to grow by 2.2 per cent in 2023, down slightly from the 2.3 per cent predicted in its February update.

Growth is expected to accelerate to 3.4 per cent in 2024 (up from the 3.3 per cent forecast in February) as inflationary pressures gradually subside.

Drivers of the downward revision for 2023 include: the economic impact of the February earthquakes and the expected tightening of credit conditions later in the year in Türkiye; delayed reforms in the southern and eastern Mediterranean; and the effect of subdued growth in advanced economies, persistent inflation and tighter financing conditions in central Europe and the Baltic States.

Growth in 2022 declined to 3.3 per cent, down from 7.2 per cent in 2021 before Russia’s war on Ukraine. And a strong start to 2022, in part thanks to a post-Covid rebound, was followed by two consecutive quarters of negative (quarter-on-quarter) growth in the second half of the year.

This technical recession is the fourth to hit the EBRD regions since the mid-1990s, the others being those after the Asian and Russian economic crises of 1997-98, the global financial crash of 2008-09 and the Covid-19 pandemic.

However, the data underlying the early estimates of quarterly gross domestic product (GDP) growth in 2022 are still preliminary and could be subject to revision.

“We are calling our new Regional Economic Prospects report Getting by,” said Beata Javorcik, the EBRD’s Chief Economist. “Inflation may be on a downward trajectory, but it is still in double digits in more than three-quarters of the countries where we work. We are also seeing lots of evidence that households in the EBRD regions are feeling the pinch, having had to struggle with two recessions, one immediately after the other.”

Inflation may have started to fall as energy prices have moderated, but in March, it still averaged 14.3 per cent across the EBRD regions.

Early results from the next round of the Life in Transition Survey, a representative household survey conducted by the EBRD in partnership with the World Bank, suggest that 55 per cent of households in the EBRD regions cannot save, as they are living from paycheck to paycheck, while 10 per cent of respondents report running up debts.

Most households have very limited buffers; 59 per cent of households in the EBRD regions report being unable to cover their basic expenses for more than a month out of savings.

More data from the Life in Transition Survey will be released later in the year, in tandem with the EBRD’s next Transition Report.

Across the EBRD regions

Growth in Central Asia is forecast to remain strong, at 5.2 per cent in 2023 (revised up from February) and 5.4 per cent in 2024. The relocation of Russian businesses and increased oil exports are boosting growth in Kazakhstan, while Mongolia is benefitting from expanded mining production and the reopening of China.

Output in central Europe and the Baltic states is expected to grow by a modest 0.5 per cent in 2023, revised down relative to February on slower-than-expected growth in advanced economies and persistent core inflation. While the region proved resilient in 2022, the post-Covid recovery has largely run out of steam and growth has recently turned negative in quarter-on-quarter terms. Growth is expected to pick up to 2.9 per cent in 2024.

Growth is also expected to decelerate in eastern Europe and the Caucasus (excluding Ukraine) as the extraordinary factors that boosted economic activity in 2022 provide limited additional stimulus. The region as a whole is forecast to grow by 1.9 per cent in 2023 and 3.3 per cent in 2024.

Ukraine’s economy is expected to grow only modestly, by one per cent in 2023 and three per cent in 2024, as businesses adapt to war circumstances.

Growth forecasts for 2023 have been revised up for the south-eastern European Union (EU) economies, supported by the prospect of eurozone accession boosting investor confidence in Bulgaria, higher public investment in Romania and the carry-over effect of stronger outturns in Greece in the last quarters of 2022. The region is expected to grow by 2.3 per cent in 2023 and 3 per cent in 2024.

Output in the southern and eastern Mediterranean is expected to grow by 3.6 per cent in 2023 and 4.4 per cent in 2024. Downward revisions for 2023 reflect delays in reforms, spill-overs from weak growth in advanced Europe, and increased fiscal and external vulnerabilities in Egypt.

Growth is Türkiye is expected to slow to 2.5 per cent in 2023 and 3 per cent in 2024. The downward revision for 2023 reflects the impact of the February 2023 earthquakes, as well as expected credit tightening in the second half of 2023.

Output in the Western Balkans is forecast to expand at a rate of 2.2 per cent in 2023 amid headwinds from inflationary pressures and a subdued outlook for the advanced economies in Europe, before picking up to 3.4 per cent in 2024. With the exception of an upward revision for Kosovo in 2023, the Bank’s forecasts are unchanged from February.

In Armenia

Growth in the first quarter of 2023 stood at a strong 12.2 per cent, but signs of moderation are gradually emerging.

Last year Armenia’s economy grew by 14.2 per cent, manufacturing sector by 7.8 per cent and services by 28.2 per cent. Construction and trade also grew in double digits.

The economy benefitted from capital inflows and exceptional growth in non-resident demand for information, communication and tourism-related services. The net inflow of money transfers almost doubled due to nearly seven-fold increase in transfers from Russian citizens coming to Armenia.

Monetary tightening and exchange rate during 2022 tamed the inflation which subsided to 5.4 per cent in March 2023. The EBRD expects Armenia’s growth to moderate to 5 per cent in 2023 and 2024, with significant risks to the growth stemming from geopolitical turbulences.

Source: National authorities and EBRD. Notes: Weights are based on the values of gross domestic product in 2022 at market exchange rates. 2022 estimates from national authorities and Refinitiv Eikon/Oxford Economics.