On January 10, the Chair of the NA Standing Committee on Financial-Credit and Budgetary Affairs Gevorg Papoyan organized a work debate aimed at the reforms of the banking system. The opposition and government deputies, the Governor of the Central Bank, the Deputy Governors, the members of the Central Bank Board and the officials of the sector attended the meeting.

Banking tariffs, digitalization, cryptocurrencies and other issues of the financial system were the focus of the meeting.

Gevorg Papoyan said that the review of the above-mentioned directions had been necessary for a long time, and the basis is the demand to keep up with the modern economic developments.

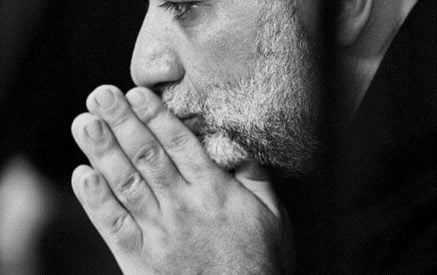

The Governor of the Central Bank Martin Galstyan stated in his turn that the impulses that the NA deputies receive from the citizens and transmit to them are very important for the Central Bank.

Read also

The debates were held in three main directions.

Introducing the sector of banking tariffs, the Director of the Financial System Stability and Regulation Directorate of the Central Bank Garegin Gevorgyan noted that there are several developments in the field of payment cards.

Speaking about non-cash transactions, the rapporteur mentioned that their tariffs have also decreased. Compared to 2021, the average tariff has decreased from 1.43% to 1.33%, but the desired result has not yet been recorded.

Touching upon the social issues, Garegin Gevorgyan pointed out that access to the point of sale (POS) terminal is ensured for the majority of the rural population. The rapporteur stated that POS terminals are already installed in all the villages with more than 1.000 inhabitants. In small villages, the picture is different, the reason is the lack of business entities and their applications.

According to the speaker, the use of cards by pensioners and receiving cashless pensions has significantly increased. In 2023, banks returned about 2.3 billion AMD to pensioners within the framework of the cash back programme.

Cryptocurrencies and instant speed transfers were also debated. The rapporteur noted that 91% of AMD transfers between the RA residents were free of charge and noted that this is a very important progress. The tariffs of banking services provided to natural persons did not change on average, most of them were provided free of charge.

According to Garegin Gevorgyan, despite the formation of culture, non-cash payments are still not widespread.

The Chair of the Standing Committee on Financial-Credit and Budgetary Affairs Gevorg Papoyan informed his colleagues that problems arise in case of paying for the parking lot in cashless drams. Gevorg Papoyan also inquired about the possibility of increasing the attractiveness of ArCa cards and the numerical indicator that 20-24 thousand POS terminals are still not used in our country. The MP asked what should be done to solve the problem.

The Deputy Governor of the Central Bank Hovhannes Khachatryan noted that ArCa cards will be with a chip from January 1, they will soon appear in the NFC system, which will make them more competitive.

The deputies asked questions to the representatives of the Central Bank, which, among other issues, related to money transfers and their tariffs, service fees charged for non-cash purchases, the turnover of the sector, the fight against the shadow, the policy conducted by banks, digitalization and its strategy.

National Assembly of the Republic of Armenia