It is designed by the draft to gradually reduce the framework of the implementation of the return system of the income tax in the amount of the paid interest sum of money by the physical person being hired employee for the service of the mortgage loan. At the regular sitting of January 15, the National Assembly debated in the first reading the addenda being envisaged in the RA Tax Code, which presented the Deputy Minister of Finance Arman Poghosyan.

Particularly, it is proposed to set that the return system of the income tax will not be applicable from January 1, 2027, if the property is in Aragatsotn, Ararat, Armavir and Kotayk marzes, adjacent to the city of Yerevan, as well as after January 1, 2029, if the property is in other marzes, except the real estate being or constructing in the border settlements included in the list approved by the Government.

It is designed by the draft law exception for the border settlements, the list of which is established by the Government decision.

Read also

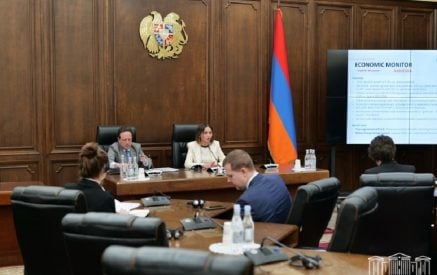

Tsovinar Vardanyan presented the endorsement of the NA Standing Committee on Economic Affairs.

The Deputy Chair of the Standing Committee on Economic Affairs Babken Tunyan presented the viewpoint of the NA Civil Contract. He touched upon his colleagues’ speeches, noting that the regulation on the income tax return had not pursued a goal to solve social problems, but had a goal to boost the construction.

The deputy urged his colleagues to vote for the draft.

National Assembly of the Republic of Armenia