Dörtyol facility booms as Moscow’s refined fuels are shipped to western buyers despite EU embargo

Nestled among the orange groves of Turkey’s southern coast stands an unlikely staging post for Moscow’s energy sales, a site from where disguised Russian fuels are shipped to European buyers — and allegedly even the US military.

For most of its existence, the Dörtyol terminal, based in the Hatay province devastated in last year’s earthquake, had been a relatively sleepy business, focused on exporting Iraqi crude that arrived at the facility by truck.

Read also

But after Russia’s full-blown invasion of Ukraine in February 2022, that all changed. Between March and June the terminal received just three shipments of oil by sea, from Israel, Egypt and Greece, according to ship tracking data from Kpler.

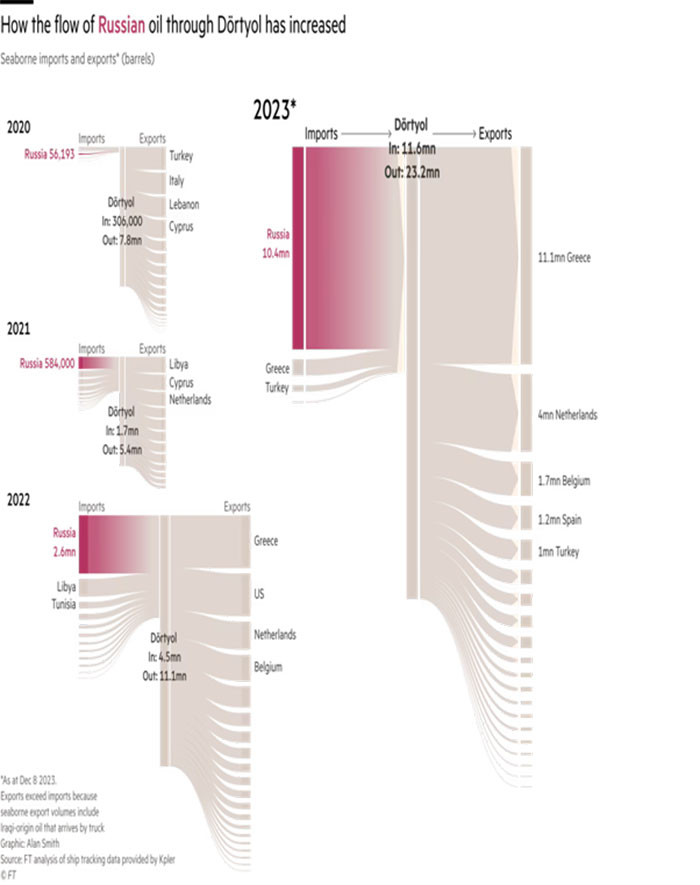

Then from July of that year, as the first western restrictions on Russian trade began to take effect, seaborne oil deliveries to Dörtyol soared, the data shows — underlining how Vladimir Putin’s war has redrawn global energy flows, creating opportunities for countries and companies still able to trade with Moscow.

Most of the oil arriving at the terminal by sea is refined fuel from Russia and much of that has then been shipped to Europe, in contravention of EU sanctions, experts who have reviewed the data said.

US senators have even raised concerns that “masked Russian oil” from Dörtyol, processed into fuel at a Greek refinery it supplies, ended up in US warships. “The mazelike path of the oil from terminals in Russia to the US fleet is almost certainly done intentionally by Russia to evade sanctions,” said US senators Marco Rubio and Maggie Hassan in a letter to the defence secretary. The US military purchases were first reported by the Washington Post.

In the EU, the importation of refined Russian oil has been banned since February last year, and crude oil since the previous December. But the trade patterns in and out of Dörtyol show how refined products are able to enter the bloc regardless.

Global Terminal Services AS, the Istanbul-based owner of Dörtyol, said it acts as “an independent storage terminal” and has no involvement in trading. The company said it had neither the “authority or responsibility” to monitor the final destination of oil moving through its facilities.

Dutch oil trader Niels Troost, who agreed to acquire a 40 per cent stake in GTS from its Turkish owners in July 2022, said he could not comment on the operations of the terminal because he had been a minority shareholder. He formally exited the business in November 2023, returning the stake to GTS, a decision by Turkey’s Competition Board approving the transaction shows.

Russian oil enters Turkey

Since the EU and the G7 imposed curbs on Moscow’s oil trade, Turkey has become a key hub for Russian crude and refined products. It is now the third-largest recipient of Russian crude after India and China, and the biggest market for Russian refined products.

In some cases, Turkey has been able to use imports of discounted Russian fuels, such as diesel, to meet domestic demand, while profitably exporting diesel produced in Turkish refineries to buyers in Europe.

In other cases, such as at Dörtyol, refined fuels from Russia appeared to have been shipped on to Europe without any significant transformation taking place, in violation of EU sanctions banning such imports.

The sprawling Dörtyol terminal, first built in 1984, sits on a hazy stretch of coastline dominated by energy and metals businesses, including Turkey’s biggest iron and steel plant.

Most of the oil arriving at Dörtyol terminal by sea is refined fuel from Russia, experts say © Adam Samson/FT

The facility is criss-crossed with a maze of pipes and pumps but has no capacity to refine fuels on site and does not import oil into Turkey. Instead it functions as a trans-shipment hub, storing oil that arrives at the facility by truck or by sea before it is shipped to buyers in other countries.

Prior to the Ukraine war, it mainly functioned as an export terminal for Iraqi crude that arrived overland. This remains a key part of the GTS business.

In 2023, between January and November, Iraqi-origin products made up a little over half of the 3.2mn tonnes of oil shipped from the terminal, GTS said in December in a written response to questions.

The rest, approximately 10.5mn barrels (about 1.5mn tonnes), arrived by sea, and 9.2mn barrels of it, almost 90 per cent, originated in Russia, the Kpler shipping data showed.

“Historically Dörtyol was always a crude export terminal,” said Viktor Katona, an analyst at Kpler. “You move to 2022 and it suddenly becomes everything.”

Dörtyol has traditionally received a small amount of oil from Russia but shipments ballooned after the start of the war. Dörtyol received 583,870 barrels (about 87,000 tonnes) of Russian-origin oil by sea in 2021 and 3.7mn barrels (about 513,000 tonnes) in 2022, representing 38 per cent and 67 per cent of all seaborne cargoes unloaded at the terminal in those years, according to the Kpler shipping data.

Turkey has not banned its companies from dealing with Russian oil, so GTS is not breaking any rules by receiving the cargoes.

But GTS disputed the figures, stating that, based on the origin information provided to the terminal by the Turkish Customs Authority, Russian volumes constituted a fifth of “total loading activity” in 2022 and 10 per cent in 2023, which would mean approximately 300,000 tonnes in each year.

The discrepancy between the volume of oil arriving at Dörtyol on tankers from Russia, tracked by Kpler, and the Russian volumes recorded by GTS, could mean that some of the terminal’s customers have provided false origin information to the Turkish Customs Authority, said Kpler’s Katona.

Kpler’s system tracks vessels from the port where they are loaded to the port where they discharge, leaving little doubt over the origin of the cargo on board.

GTS said it considered the origin information provided by the Turkish customs authority to be “final and binding”. Turkey’s trade ministry, which oversees the country’s customs directorate, did not respond to a request for comment.

On a recent visit by the Financial Times to the Dörtyol terminal, GTS commercial manager Islam Gümüş said Turkish customs had an office on the site and access to real-time video and data from the facility. “Nothing comes in here and goes out without the knowledge of the customs office,” he said.

The flow into Europe

Since there is no prohibition on bringing Russian oil into Turkey the origin information is only relevant because of what happens next: most of the oil is shipped to the EU.

In 2023, approximately 85 per cent of the oil shipped from Dörtyol went to Europe, mainly to Greece, Belgium and the Netherlands, up from 53 per cent in 2022, the shipping data shows.

For some products, such as vacuum gas oil (VGO) — a partially refined product used to make transportation fuels including petrol or diesel — the flow from Russia to Europe via Dörtyol appears even clearer. In 2023, between January and November, the terminal received 2.7mn barrels (about 412,000 tonnes) of VGO, all from Russia, and exported at least 2.5mn barrels of the product, all to Europe and mainly to Greece, the data shows.

“If the Greeks are buying this, there surely must exist a document which testifies that this is not Russian. And if there is such a document, who wrote it?” asked Katona.

GTS confirmed the terminal had shipped approximately 400,000 tonnes of VGO, but less than half had come from Russia, and less than 50,000 tonnes was destined for EU ports, it said, citing Turkish customs declarations.

Gümüş added that when GTS accepts Russian origin fuels it ensures that the shipments have been sold below the G7 price cap, even though, as a Turkish company, it is not compelled to comply with the restrictions. When the FT visited, for example, a vessel carrying Russian oil had been blocked from unloading at the terminal because the owner of the vessel had been sanctioned by the UK government.

The control room in Global Terminal Services’ Dörtyol facility. The group says its officials and customs authorities can view cameras and monitor information in real time © Adam Samson/FT

The evidence of Dörtyol’s role in the movement of Russian oil into Europe comes at a time when Turkey’s western allies have grown frustrated over the country’s economic ties with Moscow.

Trade between Russia and Turkey has increased sharply since Putin’s full invasion of Ukraine. In addition to importing Russian oil, Turkey has become a key supplier and intermediary for some of the goods Moscow needs, exporting to Russia military-linked equipment deemed vital for the Kremlin’s war machine.

The Troost connection

GTS is chaired by Ramazan Öztürk, a Turkish businessman, and owned by Öztürk’s GTS Investments BV, registered in the Netherlands, corporate records shows.

In July 2022, GTS Investments BV agreed to sell a 40 per cent stake in GTS to a Dubai-based company ultimately controlled by Troost, a 30-year veteran of the oil trading industry.

Prior to the Ukraine invasion, Troost was among the largest sellers of crude oil from eastern Russia, which he traded through Paramount Energy & Commodities SA, the company he founded in Switzerland in 2017. The Swiss entity ceased that activity before European sanctions prohibiting such trading started in December 2022, Paramount has said.

Dutch oil trader Niels Troost agreed to acquire a 40% stake in GTS from its Turkish owners in July 2022 but he formally exited the business in November 2023 © atlanticcouncil/X

However, the UK government in November imposed sanctions on a Paramount subsidiary in Dubai, accusing that company — Paramount Energy & Commodities DMCC — of employing “deceptive shipping practices as well as opaque ownership structures” to continue trading Russian oil.

In a written response to questions, Troost told the FT that his investment in GTS had nothing to do with Turkey’s growing trade in Russian refined fuels.

“I began exploring an opportunity to invest in the GTS terminal in late 2021, well before the Russian invasion of Ukraine,” Troost said. “I believed the terminal was an undervalued asset in a strategic location that could be used to supply oil products to Africa, in line with my long-term interest in African energy and food security, and the potential to develop an export business from Iraq.”

Troost added that the due diligence process for his investment was already under way in “early February”, before the 24 February invasion. His company signed a memorandum of understanding with GTS on 4 February 2022, documents show.

GTS said the terminal did not receive any oil from Troost’s Paramount or any related entity while his other company was a GTS shareholder, adding that there was no link between the investment and the increase in activity at the terminal in the past two years.

Troost said he agreed to sell his stake in GTS “in or around June 2023” due to what he described as the “serious reputational harm caused to me by a third party” who has sought “to tie me and my business to Russia on an ongoing basis”. He added that he “never saw any financial gain or benefit from the project”.