Moscow bagged €3 billion through a sanctions loophole that allows Turkey to relabel Russian oil and ship it to the EU.

by “Politico”

On a balmy spring day last May in southern Turkey just 60 kilometers from the Syrian border, a tanker the length of two football fields pulled into the Toros Ceyhan terminal ready to pick up fuel.

Read also

Loaded with 150,000 barrels of gasoil — a fuel largely the same as diesel — the ship then departed on a three-day journey toward the Motor Oil Hellas refinery in southern Greece.

Ostensibly, the fuel was Turkish; Athens insists it doesn’t accept Russian-labeled cargoes, in compliance with an EU prohibition. But new research and reporting shows the shipment was likely just that: Russian oil hidden with new markings.

That’s part of a much broader trend, according to research from the Centre for Research on Energy and Clean Air (CREA) and Center for the Study of Democracy (CSD) think tanks, as well as independent reporting from POLITICO. Russian oil, it seems, is arriving en masse to the EU via Turkey.

And it’s all legal. The scheme is possible because of a workaround in Brussels sanctions that allows “blended” fuels into the EU if they’re labeled as non-Russian. It’s a lucrative loophole, with research showing it generated up to €3 billion for Moscow from three ports alone in the 12 months after the EU banned Russia’s fuels in February 2023.

“Turkey has emerged as a strategic pit stop for Russian fuel products rerouted to the EU, generating hundreds of millions in tax revenues for the Kremlin’s war chest,” said Martin Vladimirov, a senior energy analyst at CSD.

The workaround illustrates the creative ways Russia is circumventing EU sanctions to protect its fossil fuel trade, which makes up almost half the Kremlin’s budget and offers a vital lifeline for its military campaign. Last year, POLITICO revealed Moscow won another €1 billion from a separate EU sanctions loophole in Bulgaria, while the G7’s signature measure to limit Moscow’s oil trades to $60 per barrel has largely failed.

That ballooning trade comes as relations sour between the EU and Turkey over its Russian overtures — even as the country makes minor moves to align with U.S. sanctions. Since the war began, Turkey has offered to become a gas hub for Moscow, while slurping up large volumes of its oil.

The latest revelations are prompting calls for action as EU countries discuss the bloc’s 14th Russia sanctions package.

“We must tighten our clamps and find ways to prevent the circumvention of sanctions,” Estonia’s Foreign Minister Margus Tsahkna told POLITICO. “Third countries, especially our NATO allies [like Turkey], should align with our sanctions as much as possible.”

Adding fuel to fire

Before Moscow’s invasion, the EU relied on Russia for a quarter of its crude imports and 40 percent of its diesel purchases — something that changed drastically after the bloc agreed to a blanket ban on both products in 2022.

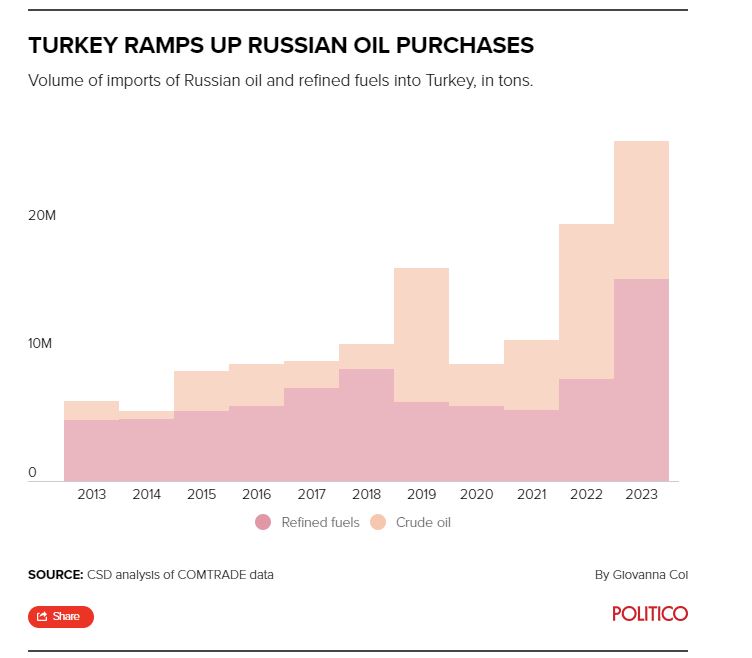

Around the same time, Turkey began quietly increasing its own imports of fuels from Russia, while also ramping up its fuel exports to the EU.

Over the last year, the numbers have nearly matched, the research reveals. Between February 2023 and February 2024, Turkey boosted its Russian purchases by 105 percent compared to the previous 12 months. In that same stretch, Turkey’s fuel exports to the EU jumped by 107 percent.

That doesn’t mean every fuel cargo arriving in the EU from Turkey is Russian. Turkey has refineries that can process almost 1 million barrels of crude per day. And Turkish firms are also likely reselling some non-Russian fuel to the EU.

But the geographical situation of several Turkish ports, combined with import-export data, strongly indicates that considerable amounts of Russian fuel has simply been repackaged and passed on.

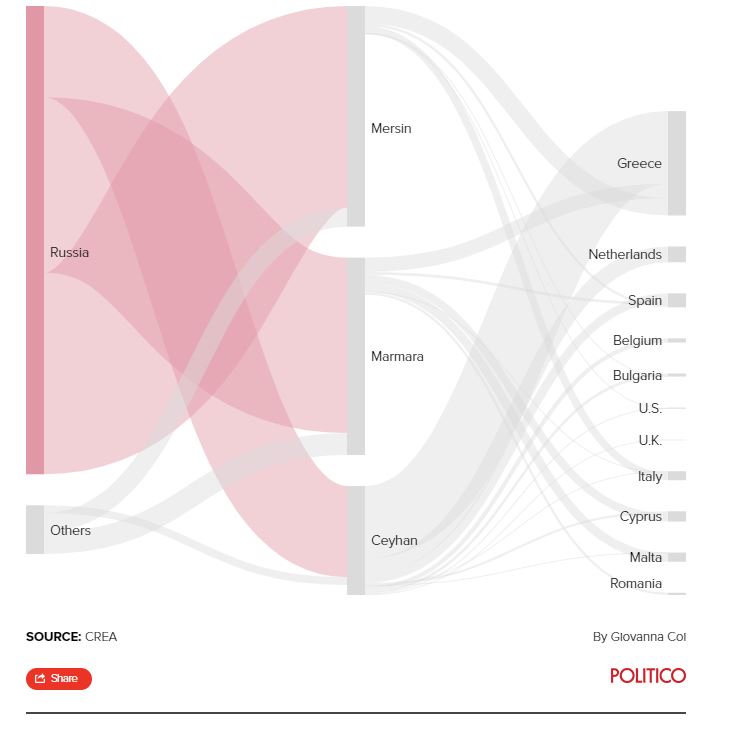

The southeastern port of Ceyhan, for example, has limited road and railway connections to refineries, giving it few means of receiving large fuel deliveries other than through the tankers docking at its piers.

Between February 2023 and 2024 the port took in some 22 million barrels of fuel, 92 percent of which came from Russia — triple the amount it imported from Moscow the year before. During that same period, 85 percent of the port’s fuel exports went to the EU.

Together, that suggests much of the Russian fuel coming in was being flipped onto the EU market under a different label.

It’s not the first time the port has come under scrutiny. In March, Global Terminal Services, which runs another export terminal nearby, said it would no longer accept Russian imports as it came under pressure from U.S. sanctions.

But Toros hasn’t taken such precautions and continued to import Moscow’s fuel, including last May’s gasoil shipment. In total the terminal received 1.4 million barrels of Russian fuel from February 2023 to 2024 — nearly all of the 1.5 million barrels it brought in during that time. Over those 12 months, it also sent 1.6 million barrels to the EU, comprising the vast majority of the 1.9 million barrels it exported.

That makes it “very likely” the terminal is re-exporting Russian fuel to the EU, said Viktor Katona, lead crude analyst at the Kpler data analytics firm. He noted that Toros’ higher export volumes can be explained by small volumes coming from a nearby refinery or fuel already in storage.

It’s a similar story at two other ports: the western Marmara Ereğlisi facility and the southern Mersin site.

Both showed similar annual spikes in their Russian imports — twofold in Marmara Ereğlisi and threefold in Mersin — that coincided with a jump in exports to the EU.

While both ports are better connected to nearby refineries and import more non-Russian fuel than Ceyhan, the data still reveals “a significant possibility that Russian oil products are being re-exported,” said Vaibhav Raghunandan, an analyst at CREA.

The owners and operators of the three Turkish terminals — Ceyhan’s Toros Terminal, Mersin’s Turkis Enerji and Marmara Ereğlisi’s OPET — didn’t reply to detailed questions from POLITICO and repeated requests for comment.

An EU sanctions workaround allows countries to buy “blended” fuel as long as it’s labeled as non-Russian. Analysis from CREA and CSD shows that Russia might be exploiting this loophole by shipping relabeled fuel to the EU via Turkish ports.Volume of seaborne oil products exported from Russia and elsewhere to the EU via three Turkish ports between February 2023 and February 2024, in tons.

‘Turkish delight’

Largely responsible for this dynamic are two players: Turkey and the EU.

Part of the problem lies in the tests Brussels uses to ensure sanctions compliance.

According to EU rules, cargoes containing Russian fuel mixed with products from elsewhere “could be subject to the sanction depending on the proportion of the Russian component.”

Usually, that share is defined by whether the fuels have undergone “substantial transformation” — becoming an entirely new product — which the data suggests has not happened across all Turkish ports.

A European Commission spokesperson declined to comment on specific cases, while arguing it was up to the bloc’s countries “to implement and enforce EU sanctions.”

Greece’s customs authority told POLITICO it carries “out appropriate controls both at the customs clearance stage and afterwards,” and that “to date, no violations have been detected.”

But in practice what is being tested is a document stating where the cargo comes from, called a “certificate of origin,” according to Katona, the analyst. Importing fuels with Russian documents is mostly illegal under EU law — but Turkey’s simply rebranding old cargoes with a new, Turkish certificate, is not.

A case in point is Toros Ceyhan’s gasoil shipment. The Motor Oil Hellas refinery, which received the cargo, said it “does not buy, process or trade Russian oil or products,” and that “all its imports are certified of non-sanctioned origin,” implying it had documents from elsewhere.

That suggests Ankara has “instilled new life into something that was already … straightforward but now has reappeared — as a Turkish delight,” Katona said, showing how “sanctions can be very easily circumvented.”

For Turkey, poor compliance with Brussels sanctions makes sense if the country feels it has nothing to lose with the EU, said Amanda Paul, a senior analyst and Turkey specialist at the European Policy Centre think tank.

With Ankara’s efforts to join the bloc at a standstill, “there doesn’t seem to be very much hope that this relationship is going to improve,” she said, while adding that imports and re-exports of cheaper Russian oil have “been very beneficial for Turkey” as the country combats sky-high inflation and a plummeting currency.

Turkey’s energy ministry didn’t respond to a request for comment.

For some in the EU, that behavior goes a step too far.

As countries discuss Brussels’ latest sanctions package, “let’s fix [this] in there,” said one EU diplomat, granted anonymity to speak candidly. Capitals “could discuss” tightening rules on Russian fuel imports from non-EU countries and sanctioning Turkish exporters, they added.

“The whole purpose of sanctions with Russia is to cut down the revenues of Russia to wage war — the more we can do, the better.”

Giovanna Coi contributed graphics to this piece.