- Economic growth fell by half in May to 5.2 percent (yoy), down from 10 percent (yoy) in April.

- Non-commercial net money transfers contracted by 44 percent (yoy) in May.

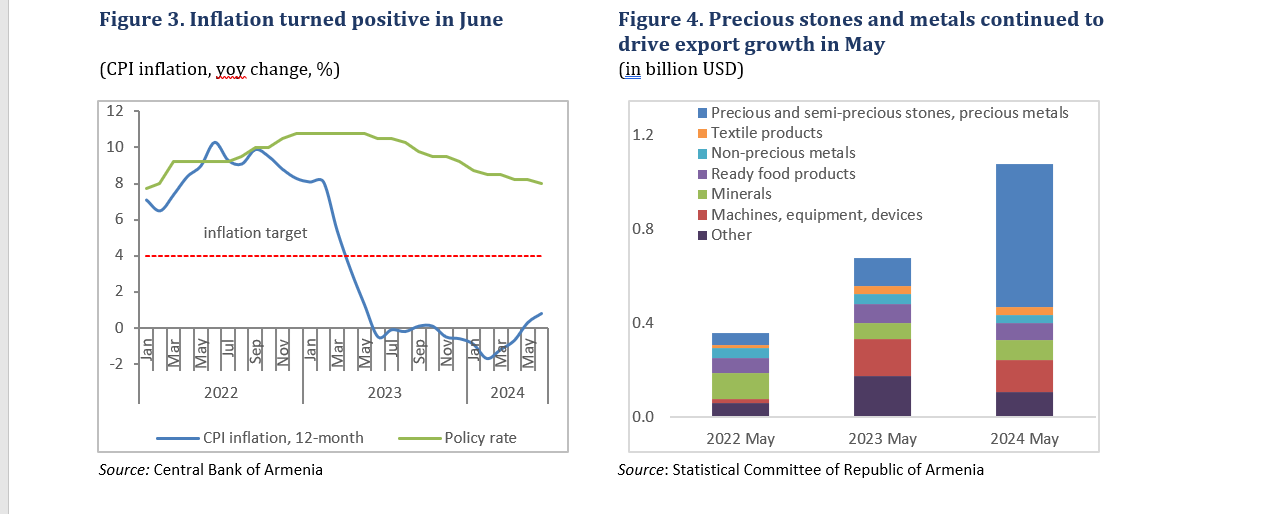

- Prices picked up for the first time since October 2023, indicating slight inflation in June.

- Strong growth in re-exports of gold and jewelry continued in May.

- Despite a deficit of AMD 46.4 billion in May, the cumulative budget remained balanced.

Growth in commercial banks’ deposits and credits increased slightly in May

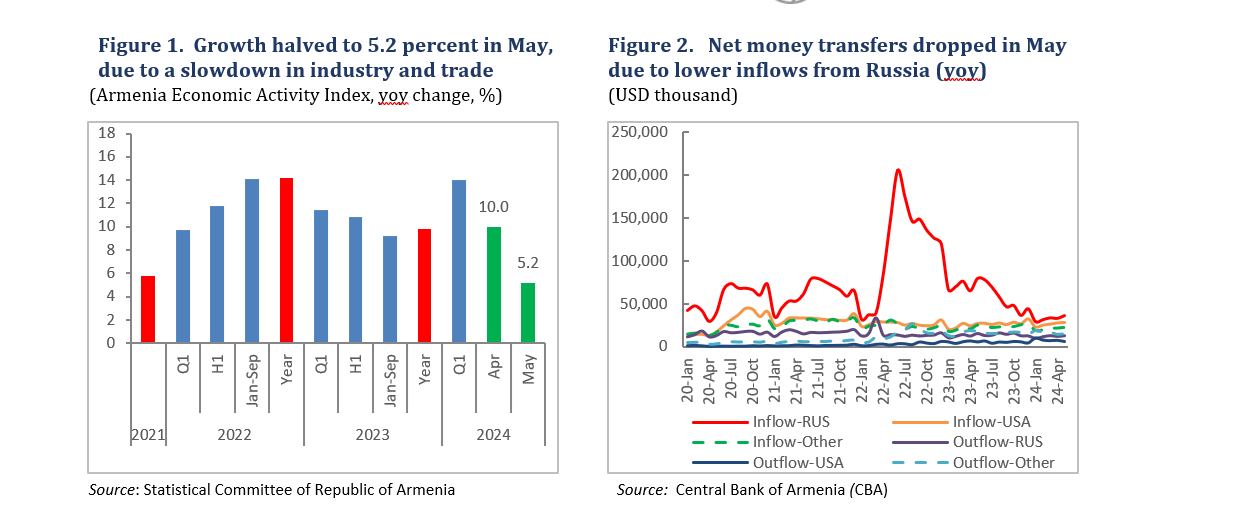

In May, economic growth fell by half to 5.2 percent (yoy), down from 10 percent (yoy) in April (Figure 1). Slower performance was mainly driven by a decline in industrial output and trade. Growth in industry decelerated to 6.9 percent (yoy), down from 16.6 percent (yoy) in April, largely due to reduced manufacturing output (11.5 percent, yoy, down from 27 percent, yoy, in April). This was caused by contraction in alcoholic beverage production (down 14 percent, yoy) and a slowdown in tobacco production (13 percent, yoy, down from 23 percent, yoy, in April). Trade growth also slowed (17.6 percent, yoy, down from 27.2 percent, yoy, in April), although growth picked up slightly in services other than trade (2.8 percent, yoy) and in construction (18.1 percent, yoy). The slowdown brought cumulative January-May economic growth to 11.2 percent (yoy), still higher than expected.

Non-commercial net money transfers contracted by 44 percent (yoy) in May, driven by a 34 percent decline in inflows. Money transfer inflows from Russia fell by 55 percent (yoy) in May, explaining most of the contraction, and inflows from the US grew by 4 percent (yoy), albeit well below the 14 percent(yoy) observed in April (Figure 2). In April, total outflows of money transfers declined by 12 percent (yoy), with those to Russia contracting by 17 percent (yoy).

Read also

Inflation, increasing for the first time since October 2023, was 0.8 percent (yoy) in June. The low inflation in June was mainly due to 10.8 percent (yoy) inflation in transport prices, only partially mitigated by mild deflation in food products (equal to 0.7 percent). Overall, the CPI average in the first half of 2024 recorded 0.6 percent (yoy) deflation. In its June 11 meeting, the CBA continued to gradually ease its policy stance, lowering the rate by 25 basis points to 8 percent. The policy rate remains well above the CBA’s pre-tightening rate of 5 percent before 2021 (Figure 3).

Gold and jewelry re-exports continued to drive export growth (Figure 4). Goods exports grew by 57.4 percent (yoy) in May, driven by a five-fold increase in precious and semi-precious stone exports (the result of a six-fold increase in imports and re-exports of these items to the UAE). Gold and jewelry’s export share reached 72.3 percent of total exports. Transport export (a re-export item in 2023) fell by 78 percent (yoy) in May 2024. Excluding the specific exports mentioned (precious and semi-precious stones and transport means), total exports contracted by 4 percent (yoy) in May. Over the January-May period, exports and imports grew by 248 percent and 200 percent, respectively, resulting in a 23 percent increase in the trade balance deficit.

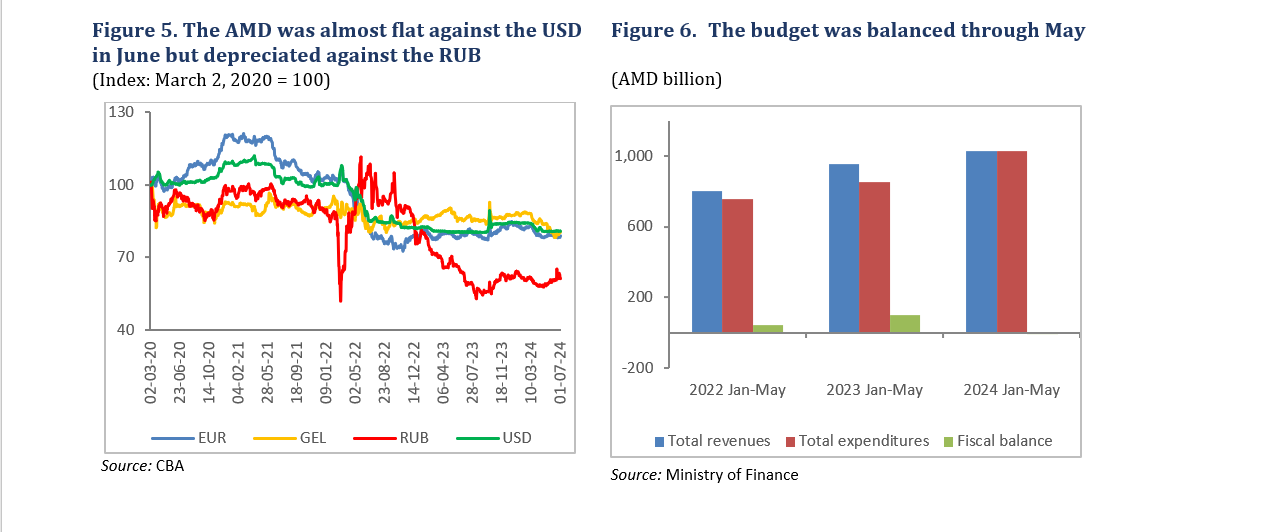

The AMD depreciated against the RUB in June. As of end-June, the AMD to USD exchange rate was just 0.2 percent weaker compared to end-May; however, the AMD depreciated by 6.3 percent against the RUB (Figure 5). International reserves continued to build up slowly, increasing by USD 126.6 million in June, to reach USD 3.34 billion (equivalent to 2.7 months of import cover).

A budget deficit of AMD 46.4 billion was recorded in May (yoy) after a surplus of AMD 47.2 billion in April (yoy). Tax revenues in nominal terms were almost flat in May, increasing by only 0.8 percent (yoy). VAT and excise collection contracted by 12.1 percent and 11.6 percent (yoy), respectively, due to moderate consumption growth. In contrast, turnover tax and income tax collections increased by 25 percent and 14 percent, respectively, and helped compensate for the decline in indirect taxes. Total expenditures contracted by 9.7 percent (yoy), owing to an 18.4 percent drop in current expenditure. On the other hand, capital expenditure more than doubled, driven by an increase in spending in road construction. The January-May cumulative budget balance showed a marginal deficit of AMD 64 million, compared to an AMD 101 billion surplus recorded in the same period in 2023 (Figure 6).

Commercial banks’ deposits and credits grew slightly in May, mostly driven by AMD-denominated funds. Total deposits grew by 3.2 percent (mom) in May, compared to marginal growth of 0.4 percent (mom) in April. This was due to a 3.4 percent (mom) growth in AMD-denominated deposits. Credit expanded by 2.2 percent (mom), mainly due to a 2 percent (yoy) increase in AMD-denominated credit.

World Bank Yerevan Office

World Bank Yerevan Office