The number of participants is about 525.000, if we do a double count, it is about 460.000. And, in fact, we believe that mutual funds are already of such great systemic importance that we should give them more opportunities to participate in investing in the Armenian economy. The Deputy Governor of the Central Bank Armen Nurbekyan said this, submitting for debate in the first reading the draft law on Making Amendments and Addenda to the law on Accumulative Pension at the NA Standing Committee on Financial-Credit and Budgetary Affairs.

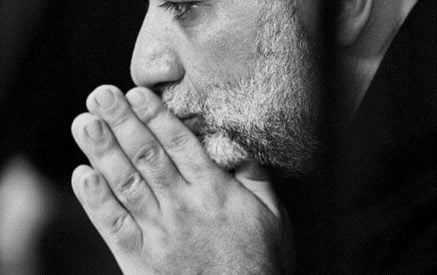

Armen Nurbekyan presented the proposing amendments. It was noted that, as a result of easing some restrictions of fund investments the opportunities for funds to invest and generate income will be expanded. An opportunity will be created to fully direct public savings to financing the real sector of the economy.

In case of high-quality investment opportunities, the funds will be able to increase the weight of investments in equity securities, participate in the financing of various projects (with international organizations and other authoritative partners), which will provide additional diversification, as well as have a positive impact on the profitability of the funds and risk indicators. In particular, according to the calculations of the Central Bank, the increasing investments in equity securities (from 25 percent to 35 percent) will make it possible to increase the expected average return (for example, an additional 0.7 percent per year on average for 30 years). As a result of all this, the probability that the return provided by funds will be lower than inflation is significantly reduced in the long term. As a result of direct investments in the real sector, including infrastructure projects (at a rate of 10 percent), it will be possible to provide high returns with lower volatility (for example, an additional 0.43 percent annual return on average over 30 years and 0.2 percent less volatility).

By giving pension fund managers the opportunity to manage other type of investment funds, fund managers will be able to apply their capabilities by creating and managing different types of funds, thanks to which different sectors of the economy and investment projects will be financed, making a significant contribution to the creation and development of alternative instruments for financing the economy.

Read also

As a result of the adoption of the draft, pension fund participants can receive information only electronically, thanks to which the person maintaining the register of participants will have the opportunity to reduce operating costs.

The Committee Chair Tsovinar Vardanyan proposed the Deputy Governor of the Central Bank to make a report at least once a year in order the citizens are informed what is going on in the pension funds. The rapporteur positively reacted to the proposal, noting that the representatives of the funds also will be involved in the measure.

Armen Nurbekyan presented some data on the profitability of the general accumulative funds. “The average profitability in 2023 was 15.3 percent, since the beginning of 2024 it has been 9.4 percent, and since the moment of its creation, it has been approximately 8 percent profitability.,” he said.

The Committee endorsed the draft. It will be proposed to include in the draft of the agenda of the NA upcoming regular sittings.

The sitting of the Committee took place on November 25.

RA NA