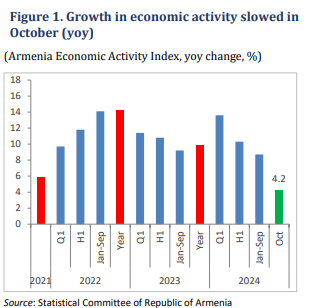

●Economic growth slowed to 4.2 percent (yoy) in October, due largely to a slowdown in services (excluding trade).

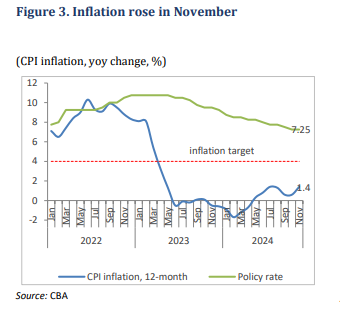

●Inflation rose to 1.4 percent (yoy) in November, driven by food and non-alcoholic beverages, and transport.

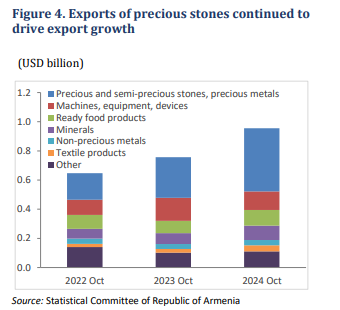

● Re-exports of gold and jewelry eased but continued to drive export growth.

● Increases in mortgages, consumer loans, and credit to the construction sector were the main drivers of credit growth.

Read also

● Public spending grew faster than revenue

collection in October.

Growth in economic activity slowed to 4.2 percent (yoy) in October, down from 7 percent (yoy) in September (Figure 1). Growth was mainly driven by services (excluding trade), which decelerated from 11.6 percent (yoy) in September to 5.2 percent (yoy) in October, due largely to a slowdown in hospitality services. Double-digit growth in construction and trade continued, each at approximately 14 percent (yoy). Industry’s growth rate rose to 5.3 percent (yoy) in October from 4.6 percent (yoy) in September, due primarily to electricity and energy (21.8 percent, yoy).

Manufacturing grew 6.6 percent (yoy). Mining contracted 10.1 percent (yoy). Cumulatively, the Economic Activity Index grew 8.1 percent (yoy) during the January-October period.

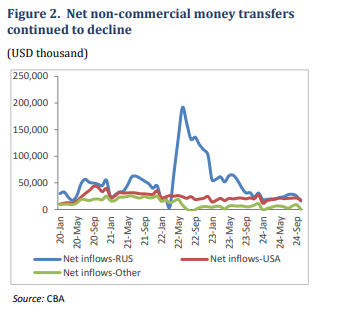

Net non-commercial money transfers fell 38.5 percent (mom) in October (Figure 2). Net inflows fell (mom) from all sources in October, including Russia (38 percent, mom), the United States (16.2 percent, mom), and other countries (94 percent, mom). Net inflows were also significantly lower compared with October 2023 (down 41 percent, yoy).

Inflation increased to 1.4 percent (yoy) in November, up from 0.6 percent (yoy) in October (Figure 3). November’s increase was mainly due to 3.1 percent higher prices for food and non-alcoholic beverages (mom). In October, while apartment rental prices showed almost no increase in the CPI, cadastral data revealed a 2.4 percent (yoy) increase in apartment transaction prices in central Yerevan; and a 58.6 percent (yoy) rise in the number of transactions, a surge in activity attributed to the ending of the mortgage interest rate refund program for Yerevan, effective from January 2025.

Exports grew 23.1 percent (yoy) and imports grew 6.6 percent in October. Export growth slowed from 39 percent (yoy) in September and remained driven by reexports of precious and semi-precious stones and metals. All top export categories experienced yoy growth in October except for machinery and equipment, (down 19.8 percent, yoy). Significant growth occurred in precious and semi-precious stones and metals (55.5 percent, yoy, despite the continuing slowdown in growth rates observed since May 2024); textiles (59.6 percent, yoy); minerals (32.5 percent, yoy); and food

products (27.7 percent, yoy). Excluding precious and semi-precious stones, all exports grew 9.1 percent (yoy) (Figure 4). Cumulatively, exports doubled in JanuaryOctober, while imports grew 50 percent, resulting in the trade deficit narrowing 17.9 percent (yoy).

In November, the AMD started to depreciate against the USD and continued to appreciate against the RUB. By end-November, the AMD was 1.8 percent (mom) weaker against the USD and 8 percent (mom) stronger against the RUB. International reserves remained stable at USD 3.6 billion (2.2 months of import cover) by end-November.

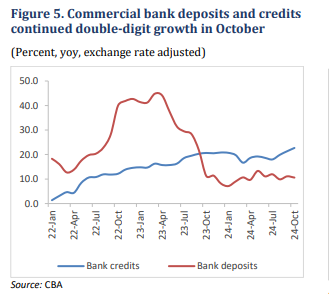

Commercial bank deposits increased 1.3 percent (mom) in October, and loans grew at 2.2 percent (mom), driven by AMD-denominated funds.

Compared with 2023, exchange rate adjusted deposits grew 11 percent (yoy) in October, and credits rose 23 percent (yoy) (Figure 5).

Mortgages, consumer loans, and credit to the construction sector account for two

thirds of the increase. Financial indicators remained robust, with the Capital Adequacy Ratio edging up 0.1pp in October, to 20.5. The NPL ratio stayed low, at 1.2

percent, and return on assets remained at 4.5 percent.

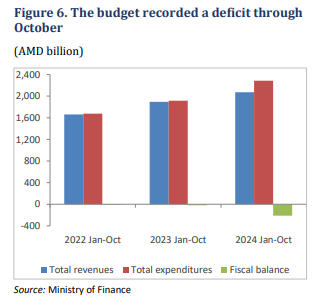

A budget deficit of AMD 138.5 billion (1.34 percent of GDP) was recorded in October. Tax revenues (including mortgage-related income tax) expanded 14.9 percent (yoy) in nominal terms in October; of these, more than half were driven by higher personal income tax collection (up 36.5 percent). VAT collection grew a modest 1.8 percent (yoy), down from 3.9 percent (yoy) growth in September. Total expenditure increased 25.4 percent (yoy) in October, primarily driven by a 45.5 percent yoy increase in public administration (including payment on debt services), defense (64 percent, yoy), and social protection (6 percent, yoy).

Capital expenditure soared 44.4 percent (yoy) in October, bringing cumulative capital expenditure to 3.4 percent of GDP, half the annual plan for capital

expenditure. The cumulative budget deficit stands at AMD 211.5 billion (Figure 6), accounting for 2.1 percent of annual GDP, compared with the budget deficit annual

plan of 4.7 percent.

World Bank