Armenia monthly economic update – JANUARY 2025

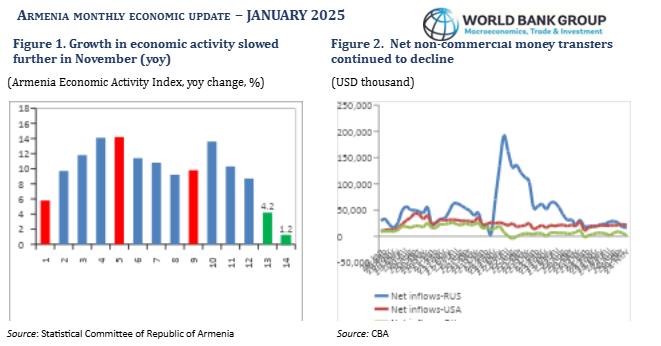

- Economic growth slowed to 1.2 percent (yoy) in November due to a sharp contraction in industry.

- Net non-commercial money transfer inflows continue to decline.

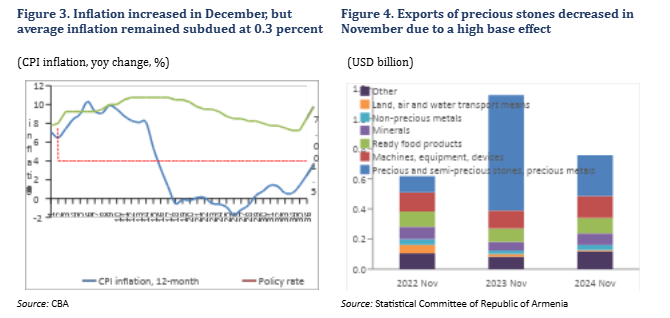

- Inflation rose to 1.5 percent (yoy) in December.

- Trade turnover fell (yoy) due to lower re-exports of gold and jewelry.

The budget deficit increased in November, while the cumulative deficit, at 2.3 percent of GDP, was half of the annual projection for 2024.

In November, growth in economic activity fell to 1.2 percent (yoy), from 4.2 percent (yoy) in October (Figure 1). The November decline was mainly driven by a 19 percent (yoy) contraction in industry, which was impacted by a 24.4 percent (yoy) decrease in manufacturing and a 6.9 percent (yoy) drop in mining. Manufacturing output declined mainly due to a 70 percent contraction in base metal production. The other main manufacturing categories, such as food, cigarettes, and beverages, continued to grow. All other sectors grew: services (excluding trade) doubled from 5.2 percent (yoy) in October to 10.4 percent (yoy) in November; construction and trade continued their double-digit growth. Over January-November, cumulative growth reached 7.4 percent (yoy), driven by an 18 percent (yoy) growth in trade.

Net non-commercial money transfers fell 14.3 percent (mom) in November. Net inflows decreased (mom) from all sources, including Russia (6.2 percent, mom), the United States (6.4 percent, mom), and other countries (69 percent, mom) (Figure 2). Compared with November 2023, net inflows were 21.7 percent (yoy) lower, mainly due to a decline in net inflows from Russia.

Inflation picked up to 1.5 percent (yoy) in December, the highest rate since April 2023 (Figure 3). This was due to higher inflation for food and non-alcoholic beverages (at 2 percent, yoy, in December, up from 1.7 percent in November); and for healthcare, which rose to 3.2 percent (yoy) in December from 2.5 percent (yoy) in November. Prices in December continued to decline for clothing and footwear (down 2.6 percent, yoy), furnishings and household equipment (down 2.5 percent, yoy), and housing and utilities (down 0.2 percent, yoy). In 2024, average inflation was 0.3 percent, compared with 2 percent in 2023. On December 10, 2024, the CBA Board cut the policy rate by 25 basis points, to 7 percent, bringing the cumulative cut in 2024 to 225 basis points. The policy rate is back to the August 2022 level.

Read also

The trade turnover fell in November 2024 (yoy), following strong growth in previous months. Exports fell 35 percent (yoy) in November, after a 23.6 percent (yoy) increase in October. Imports also fell 21.4 percent, after a 9.2 percent (yoy) increase in October. The sharp November decline was driven by lower exports (down 64.6 percent, yoy) and imports (down 70.6 percent, yoy) of precious and semi-precious stones, explained by a high base effect of this re-export category, which had started to surge in November 2023. Exports and imports of transport facilities fell by 54 percent (yoy) and 35 percent (yoy), respectively, following a mid-2023 ban by Georgia on car re-exports to Russia. All other export categories experienced yoy growth except for oils and fats (down 56 percent, yoy), and wooden items (down 13 percent, yoy). Excluding precious and semi-precious stones and transport facilities (re-exports of major items), total exports grew 32 percent (yoy) (Figure 4). Cumulatively through November, exports and imports grew 73.9 percent (yoy) and 41.5 percent (yoy), respectively, with the trade deficit narrowing 13.9 percent (yoy).

In December, the AMD depreciated slightly against the USD and the RUB. The AMD started to depreciate in early December but stabilized later in the month. By end-December, the AMD had weakened 0.5 percent (mom) against the USD and 1.4 percent (mom) against the RUB. At end-December, international reserves were at USD 3.7 billion (2.5 months of import cover).

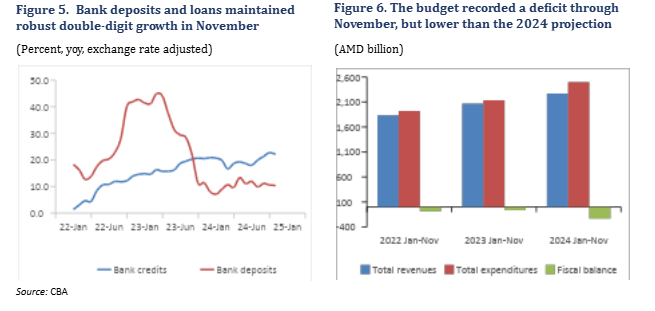

Commercial bank deposits grew 2.3 percent (mom) in November, and loans increased 2.6 percent (mom), driven by AMD-denominated funds. Exchange rate-adjusted deposits grew 10.4 percent (yoy) in November, and credits rose 22.1 percent (yoy) (Figure 5). Financial indicators remained sound in November. The Capital Adequacy Ratio (CAR) fell 0.1pp, to 20.4 percent. The Non-performing Loans (NPL) ratio remained low, at 1.2 percent, and return on assets fell slightly to 4.3 percent, down from 4.5 percent in October.

The budget deficit decreased to AMD 20.7 billion in November (compared to AMD 138.5 billion in October). Tax revenues (including mortgage-related income tax) grew 11.1 percent (yoy) in nominal terms, driven by increases in VAT (15.7 percent, yoy) and income tax (15 percent, yoy). However, profit taxes fell 32 percent (yoy). Total expenditure fell 0.8 percent (yoy) in November, mainly due to reduced defense spending (down 45.2 percent, yoy). This was partly compensated by a 35 percent (yoy) increase in social protection spending, with support for refugees continuing. Capital expenditure fell 44.5 percent (yoy) in November, bringing cumulative capital expenditure to 3.8 percent of GDP, 55 percent of the 2024 projection. The cumulative budget deficit reached AMD 232.2 billion (Figure 6), equivalent to 2.3 percent of annual GDP, compared to the 2024 projected budget deficit of 4.7 percent.

World Bank Yerevan Office