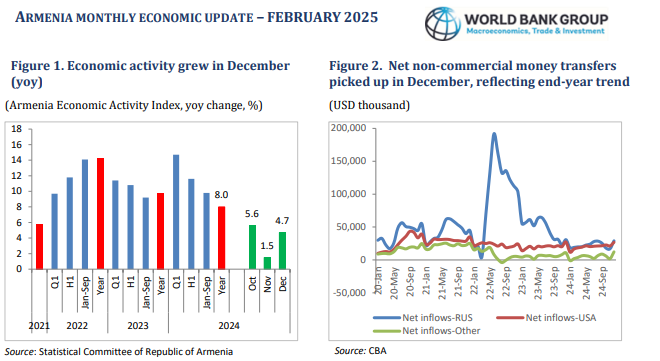

● Economic growth increased to 4.7 percent (yoy)

in December 2024.

● Net non-commercial money transfer inflows rose

slightly.

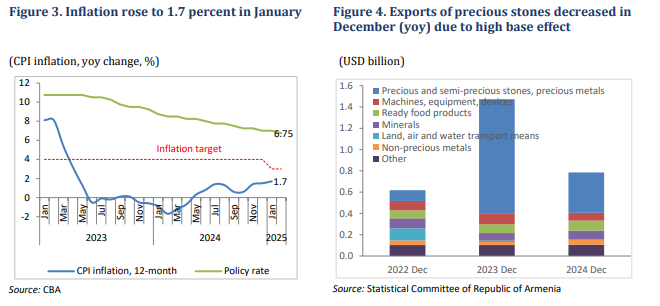

● Inflation rose to 1.7 percent (yoy) in January.

● The current account deficit was 24 percent (yoy)

higher over the January-September 2024 period

than in 2023.

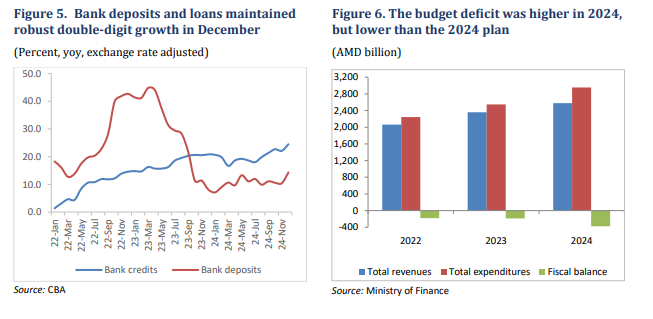

● The budget deficit reached 3.6 percent of GDP in

2024.

Growth in economic activity rose from 1.5 percent (yoy) in November to 4.7 percent (yoy) in December, bringing annual growth to 8 percent (Figure 1). December growth was mainly driven by a 19.4 percent (yoy) expansion in services (excluding trade), a 12.9 percent (yoy) rise in construction, and 10.3 percent (yoy) in trade. For the second consecutive month, industry contracted by 14.8 percent (yoy) in December, driven by a decline in manufacturing (down 18 percent, yoy) and mining (down 16.2 percent, yoy). The decline in manufacturing was driven by a fall in production of alcoholic beverages (down almost 20 percent) and base metals (down 70 percent). Cumulative growth in 2024 reached 8 percent (yoy), driven by double-digit growth in services and construction. After flat growth in 2023, agriculture grew 1.9 percent (yoy) in 2024. The unemployment rate rose to 13.3 percent in Q3 2024, slightly higher than the 12 percent registered in Q3 2023, mostly due to higher unemployment in rural areas.

Net non-commercial money transfers increased 70.4 percent (mom) in December. Net inflows soared (mom) from all sources, mostly reflecting year-end higher transfers, particularly from Russia (up 72.2 percent, mom) (Figure 2). Compared with December 2024, net inflows were down 1.1 percent (yoy), owing to a 5.6 percent (yoy) fall in net inflows from Russia.

Inflation rose to 1.7 percent (yoy) in January 2025, the highest yoy rate since April 2023 (Figure 3). This was mainly driven by a 2.5 percent (yoy) rise in food and non-alcoholic beverage prices, up from 2 percent in December. Both transport and healthcare prices rose 3.2 percent (yoy), contributing to the rise in inflation. On February 4, 2025, the CBA Board lowered the policy rate by 25 basis points, to 6.75 percent. A new 3 percent (+/–1 pp) inflation target was adopted in January.

Exports and imports fell for the second consecutive month (yoy) in December. Exports fell 48.6 percent (yoy) in December, after contracting 33.7 percent (yoy) in November. Imports also fell, down 26.5 percent (yoy), following an 18.5 percent contraction in November. As in November, the December decline was due to contraction in the export of precious and semi-precious stones (down 65 percent, yoy) and imports (down 48.8 percent, yoy). Exports and imports of transport facilities also fell 51 percent (yoy) and 34 percent (yoy), respectively. This continues the trend observed following Georgia’s mid-2023 ban on car re-exports to Russia. Exports of oils and fats increased significantly (31-fold) in December (yoy). Excluding precious and semi-precious stones and transport facilities (major re-export items), exports grew 4.6 percent (yoy) in December (Figure 4). Cumulatively in 2024, exports and imports grew 53.1 percent (yoy) and 33.8 percent (yoy), respectively, with the trade deficit narrowing 5.5 percent (yoy). Based on end-September 2024 BOP data, the current account deficit deteriorated to 2.9 percent of annual GDP, compared to 2.5 percent in the same period of 2023. While the trade balance improved slightly in this period, it could not offset deterioration in the services account (due mostly to a 53 percent decline in tourism-related surpluses) and in the income balance. The number of tourists in 2024 fell 4.7 percent (yoy), driven by a 17.5 percent decline in the number of visitors from Russia.

In January, the AMD was mostly stable against the USD and depreciated against the RUB. By end-January, the AMD had depreciated by 8.9 percent (mom) against the RUB. International reserves picked up to USD 3.3 billion in January (2.3 months of import cover).

In December, commercial bank deposits and credits grew 4.6 and 3.9 percent (mom), respectively, both driven by AMD-denominated funds. Exchange rate-adjusted deposits grew 14.3 percent (yoy) in December, and credits rose 24.5 percent (yoy) (Figure 5). Financial indicators remained sound in December, with the Capital Adequacy Ratio at 20.2 percent. The Non-performing Loans ratio stayed low at 1.2 percent and return on assets remained at 4.3 percent.

Armenia recorded a large budget deficit in December (AMD 143.8 billion), comprising about 40 percent of the total annual deficit in 2024. In December, tax revenues (including mortgage-related income tax) fell 9.5 percent (yoy) in nominal terms, driven by a decline in the collection of VAT on imports (15.8 percent, yoy), excise tax (19.6 percent, yoy), income tax (12 percent, yoy) and other taxes (51.3 percent, yoy). However, there was growth in the collection of state duty (17.5 percent, yoy), environmental tax (35 percent, yoy) and social payment (12.4 percent, yoy). Total expenditure grew 9.4 percent (yoy) in December, mainly due to increased spending on education (38 percent, yoy), with significant school infrastructure construction, and social protection (16.6 percent, yoy) because of support for refugees. Capital expenditure grew 8.2 percent (yoy) in December, bringing cumulative capital expenditure to 5.4 percent of GDP; however, this was still 21.5 percent below the annual plan. The cumulative budget deficit reached AMD 376.1 billion (Figure 6), equivalent to 3.6 percent of annual GDP, lower than the 4.7 percent projection for 2024, mostly due to underperformance of capital expenditure.

Read also

World Bank Armenia