- Economic growth slowed to 1.5 percent (yoy) in February.

- Net non-commercial money transfer inflows picked up in February (yoy).

- Inflation rose to 3.3 percent (yoy), exceeding the inflation target.

- Exports and imports continued to contract as re-exports phase out.

- Financial indicators remained sound.

- The budget recorded a surplus in January-February.

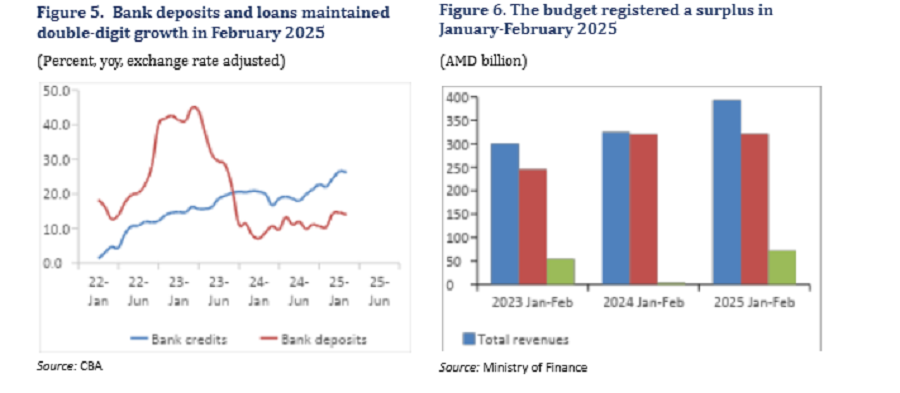

Growth in economic activity slowed to 1.5 percent (yoy) in February 2025, down from 7.1 percent (yoy) in January (Figure 1). The first two months of 2025 brought cumulative growth to 4.1 percent (yoy). In February, the significant decline in economic activity was due to contraction in the industrial sector (down 26.6 percent, yoy). This was driven by a fall in manufacturing (down 33.3 percent, yoy), due to reduced alcoholic beverage, base metal, and mining production (down 29.7 percent, yoy). Transport and communication also declined, down 5.1 percent (yoy) and 1.2 percent (yoy), respectively. Construction and services continued their double-digit growth, up 12.7 percent (yoy) and 12.1 percent (yoy), respectively. In 2024, the Q4 unemployment rate was lower compared with the previous quarters; however, the annual unemployment rate stood at 13.9 percent, higher than the 12.4 percent recorded in 2023, due to rising unemployment in urban and rural areas for both women and men.

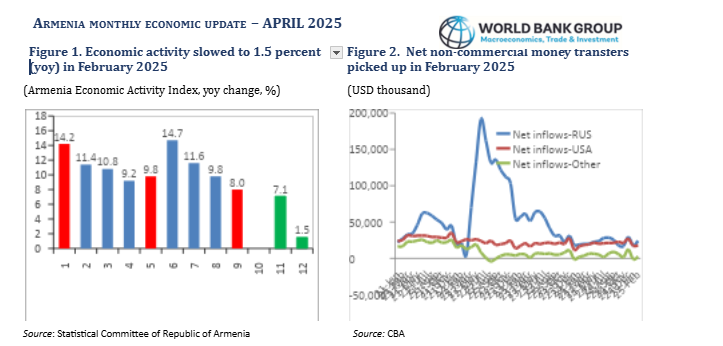

On the demand side, average real wages have increased in 2025, and net money transfers have shown an upward trend, contributing to consumption growth. In the first two months of 2025, average real wages increased 2 percent (yoy), with limited impact on consumption. Net non-commercial money transfers began to recover in January, following a 35 percent (yoy) decline in 2024. In February, they increased 29 percent (mom), driven by increases from all sources, particularly Russia (up 34.9 percent, mom) and other countries (up more than three-fold) (Figure 2).

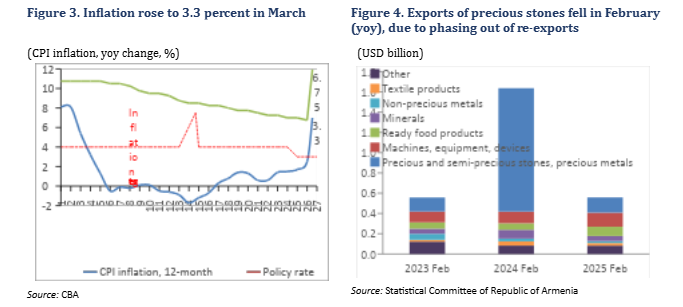

Inflation rose to 3.3 percent (yoy) in March 2025, exceeding the 3 percent inflation target (Figure 3). This was the highest yoy rate since April 2023 and was mainly driven by a 5.4 percent (yoy) rise in food and non-alcoholic beverage prices. On March 18, 2025, the Central Bank of Armenia (CBA) Board decided to keep the policy rate unchanged at 6.75 percent.

Exports and imports continued to contract significantly (yoy) in February 2025 due to a high base effect (Figure 4). In February, exports and imports fell 67.7 percent (yoy) and 46 percent (yoy), respectively. As in previous months, the decline was due to contraction in re-exports of precious and semi-precious stones (down 88 percent, yoy). Mineral exports also contracted, due to a 45 and 93 percent (yoy) decline in copper and gold exports, respectively caused by continues challenges in operations of the mines. Exports of other items also fell, although there were increases in the export of agricultural products (up 90 percent, yoy), ready food products (up 42 percent, yoy), and machinery (up 22 percent, yoy). Cumulatively, in January-February, exports and imports dropped 59.7 percent (yoy) and 45.8 percent (yoy), respectively, with the trade deficit widening 10.8 percent (yoy). Over the period, 44 percent of total exports went to Russia, 22 percent to United Arab Emirates, 7 percent to EU countries, and 0.6 percent to the USA.

Read also

In March 2025, the AMD was largely stable against the USD but depreciated against the RUB. By end-March, the AMD/USD had appreciated 1.3 percent and the AMD/RUB had depreciated 24.4 percent, compared with end-December 2024. International reserves rose to USD 3.9 billion in March 2025, equivalent to 2.9 months of import cover.

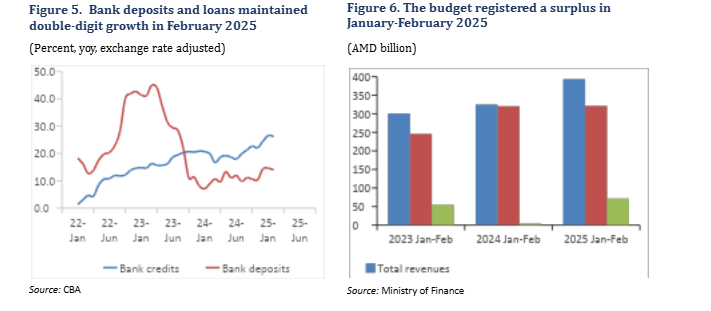

In February 2025, commercial bank deposits grew 1 percent (mom), while credit decreased 0.1 percent (mom). Both were driven by AMD-denominated funds. Exchange rate-adjusted deposits grew 14 percent (yoy) in February, and credit rose 26.2 percent (yoy) (Figure 5). Financial indicators remained sound, with the capital adequacy ratio (CAR) at 20 percent. Non-performing loans (NPL) rose to 1.5 percent in March, compared with 1.2 percent in January; return on assets fell to 2.9 percent, from 4.3 percent in February.

Armenia recorded a deficit of AMD 28.5 billion in February 2025, following an AMD 100 billion surplus in January. This resulted in a cumulative budget surplus of AMD 71.6 billion (approximately 0.7 percent of GDP) (Figure 6). In February, tax revenues (including mortgage-related income tax) grew 11 percent (yoy) in nominal terms, mostly driven by 15.4 percent growth in VAT and 8.5 percent higher income tax. In February, total expenditure contracted 10.7 percent (yoy), due largely to 36.7 percent (yoy) reduced capital expenditure (mostly on defense). Cumulative capital expenditure reached 0.4 percent of GDP at end-February, accounting for about 20 percent of the ambitious capital expenditure plan for Q1 2025.

World Bank