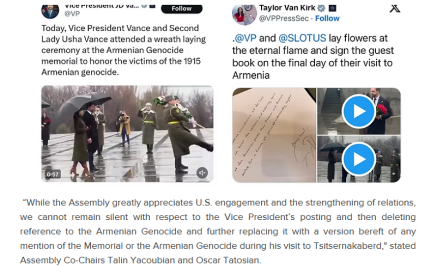

|

In March, economic activity increased 3.7 percent (yoy), up from 1.8 percent (yoy) in February 2025 (Figure 1). Cumulative growth in Q1 2025 reached 4.1 percent (yoy). Industrial activity continued its double-digit contraction (down 16.9 percent, yoy), primarily driven by a 25.6 percent (yoy) fall in manufacturing due to a sharp reduction in base metal production. However, for the first time since February 2024, mining showed growth of 6.7 percent (yoy). Strong growth continued in construction (up 15.5 percent, yoy) and services, excluding trade, (up 10.1 percent, yoy). Trade grew 3.2 percent (yoy), slower than the 6 percent (yoy) growth recorded in February. Monthly business registrations grew 4 percent (yoy), mostly driven by an 11.2 percent (yoy) rise in limited liability company (LLC) registrations.

In March, real wages and net money transfers increased. Average real wages increased approximately 5 percent (yoy) and net non-commercial money transfers continued to pick up, rising 23.6 percent (yoy). This was mostly due to higher net inflows from Russia (up 32 percent, yoy) and the US (up 14 percent, yoy) (Figure 2).

In April, inflation slowed slightly, but still exceeded the 3 percent target (Figure 3). The 3.2 percent (yoy) inflation in April was slightly below the 3.3 percent (yoy) recorded in March. The main inflation drivers were food and non-alcoholic beverages (up 5.2 percent, yoy); health (up 3.3 percent, yoy); transport (up 4.2 percent, yoy); and alcoholic beverages (up 6.1 percent, yoy). Prices for communications, clothing and footwear, and household furnishing and maintenance decreased slightly. On May 6, 2025, the Board of the Central Bank of Armenia (CBA) decided to keep the policy rate unchanged at 6.75 percent.

Read also

In March, exports and imports continued to decline, due to a high base effect (Figure 4). Exports and imports fell 65.4 percent (yoy) and 51.2 percent (yoy), respectively. This was due to shrinkage in the re-export of precious and semi-precious stones (exports were down 86.1 percent, yoy). Excluding trade in precious and semi-precious stones, total exports and imports grew 23 percent (yoy) and 16 percent (yoy), respectively. Total export growth was primarily driven by minerals (up 43.5 percent, yoy); machinery (up 25.6 percent, yoy); and ready food products (up 23.1 percent, yoy). However, exports of textiles and means of transport fell (down 10.2 percent, yoy, and 56.1 percent, yoy, respectively). Cumulatively, in Q1 2025, exports and imports fell 61.8 percent (yoy) and 47.9 percent (yoy), respectively, and the trade deficit widened 22.1 percent (yoy); 41.1 percent of total exports went to Russia, 24.7 percent to the UAE, 7.7 percent to EU countries, and 0.5 percent to the US.

In April, the AMD appreciated against the USD and depreciated against the EUR and the RUB. The AMD appreciated by 0.4 percent against the USD but was weaker against the EUR (down 4.5 percent) and RUB (down 4 percent), reflecting recent, pronounced USD depreciation.

In March, commercial bank deposits and credit grew 1.5 percent (mom) and 2.9 percent (mom), respectively. Deposit growth was driven by AMD-denominated funds, whereas credit growth was FX-credit driven. Exchange rate-adjusted annual growth in total deposits and in credit was 13.4 percent (yoy) and 30.1 percent (yoy), respectively (Figure 5). Financial indicators remained sound in March, with the capital adequacy ratio (CAR) at 20.2 percent. Non-performing loans (NPLs) stabilized at 1.5 percent and returns on assets grew to 3.4 percent, up from 2.9 percent in February.

Despite an AMD 50.4 billion deficit in March, the cumulative budget in Q1 2025 remained in surplus, at AMD 21.2 billion (approximately 0.2 percent of GDP) (Figure 6). In March, tax revenues (including mortgage-related income tax) fell 2.1 percent (yoy) in nominal terms, due primarily to the return of overpayments on environmental royalties received in 2024. Increases in VAT (up 17.4 percent, yoy); profit tax (up 7.6 percent, yoy); and excise taxes (up 19.3 percent, yoy) partly compensated for the return of environmental taxes. Total expenditure grew 24.1 percent (yoy), due largely to a 25.8 percent (yoy) increase in current expenditure, arising from a 49 percent (yoy) increase in social spending. Cumulative tax collection in Q1 2025 met the budget, whereas expenditure was under executed, particularly capital expenditure, which underperformed by 67 percent of the Q1 2025 budget. This resulted in a surplus of 0.2 percent of GDP instead of the planned 2.2 percent deficit.

| Figure 1. Economic activity grew 3.7 percent (yoy) in March 2025 | Figure 2. Net non-commercial money transfers continued to pick up | ||

| (Armenia Economic Activity Index, yoy change, %) | (USD thousand) | ||

| Source: Statistical Committee of Republic of Armenia | Source: CBA | ||

| Figure 3. Annual inflation reached 3.2 percent in April 2025, slightly lower than in March | Figure 4. Exports of precious stones fell in March 2025, as re-exports were phased out | ||

| (CPI inflation, yoy change, %) | (USD billion) | ||

| Source: CBA | Source: Statistical Committee of Republic of Armenia | ||

| Figure 5. Bank deposits and credit continued double-digit growth | Figure 6. The budget recorded a surplus in Q1 2025 | ||

| (Percent, yoy, exchange rate adjusted) | (AMD billion) | ||

| Source: CBA | Source: Ministry of Finance | ||

World Bank