- Economic growth rose to 8.9 percent (yoy) in July, bringing cumulative growth to 7.1 percent.

- Net non-commercial money transfers increased 42.3 percent (yoy) in July, driven by inflows from Russia.

- Inflation rose to 3.6 percent in August and the CBA kept the refinancing rate unchanged.

- Exports and imports continued to decline (yoy), due to the phasing out of the re-export of precious stones and metals.

- The budget recorded a cumulative deficit of 0.6 percent of GDP over the January-July period.

In July, growth in economic activity reached 8.9 percent (yoy), up from 6.7 percent (yoy) in H1 (Figure 1).

Growth in July was driven by robust activity in construction (up 26.1 percent, yoy); services excluding trade (up 11.1 percent, yoy); and industry (up 4.2 percent, yoy, following a contraction of 1.2 percent, yoy, in June). Industrial growth was buoyed by a 31.5 percent (yoy) surge in electricity production; and by a 3.3 percent (yoy) rise in manufacturing, supported by greater production of food (up 11 percent, yoy) and tobacco (up 39 percent, yoy). Mining activity remains volatile, falling 8.4 percent (yoy) in July, following 10 percent (yoy) growth in June. Trade grew 3 percent (yoy).

Monthly business registrations increased 4 percent (yoy) in July, due to a 30.2 percent (yoy) rise in LLCs, which helped compensate for a 3.9 percent (yoy) fall in registrations by individual entrepreneurs.

In July, net non-commercial money transfers continued strong growth, at 42.3 percent (yoy). This was driven by a 68.9 percent (yoy) increase in net inflows from Russia, representing 65 percent of total net inflows, and a 16.4 percent (yoy) rise in net inflows from the United States (Figure 2).

Read also

In Q1, the unemployment rate declined to 14 percent, down from 15.5 percent in Q1 2024, while the employment and labor force participation rates stood at 50.1 percent and 58.2 percent, respectively.

Annual inflation rose to 3.6 percent in August, up from 3.4 percent in July (Figure 3).

Inflation remained high for food and non-alcoholic beverages (4.9 percent), alcoholic beverages (6.6 percent), education (7.8 percent), and transport (6 percent).

On August 5, the board of the Central Bank of Armenia kept the policy rate unchanged at 6.75 percent and announced that it expected to gradually lower the refinancing rate to approximately 6.25 percent over the next 12 months.

In July, exports and imports contracted due to the ongoing phasing out of re-exports (Figure 4).

Exports fell 15.4 percent (yoy) in July, compared with the 39 percent (yoy) fall recorded in May. Imports fell 16.5 percent (yoy), a similarly smaller decline compared with May.

In July, exports and imports of precious and semi-precious stones and metals fell around 59 percent (yoy), emerging as the main driver of the overall contraction in total exports and imports. Exports of vehicles also continued to contract (down 36.4 percent, yoy).

These falls were attenuated by growth in exports of agricultural products (up 23.3 percent, yoy); ready foods (up 24.3 percent, yoy); machinery (up 36.4 percent, yoy); and minerals (up 11.8 percent, yoy).

Excluding the re-export trade in precious metals and stones, exports and imports grew 19 percent (yoy) and 5.5 percent (yoy), respectively. In July 2025, tourist arrivals rose 11 percent (yoy), the third consecutive month of growth.

Although cumulative arrivals over January-July fell one percent (yoy), the increase suggests momentum is gradually recovering. In August, gross international reserves increased USD 173.6 million to USD 4.2 billion, equivalent to 3.4 months of import cover.

In August, the AMD appreciated 0.3 percent (mom) and 1.3 percent (yoy) against the USD. It remained stable vis-à-vis the RUB (mom), while depreciating 1.7 percent against the EUR. Since the beginning of 2025, the AMD has appreciated 3.7 percent against the USD; the CBA intervened in the FX market over the February-June period and purchased approximately USD 750 million to smooth exchange rate fluctuations.

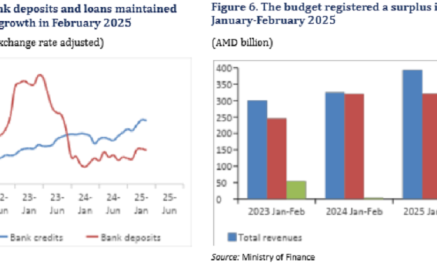

In July, commercial bank deposits and credit grew 0.3 percent (mom) and 1.2 percent (mom), respectively. The July pickup in deposits and credit, relative to June, was largely supported by higher AMD-denominated instruments, with credit growth primarily fueled by the expansion of consumer loans and credit to financial and insurance activities.

Exchange rate-adjusted annual growth was 13.6 percent (yoy) in total deposits and 28.5 percent (yoy) in credit (Figure 5).

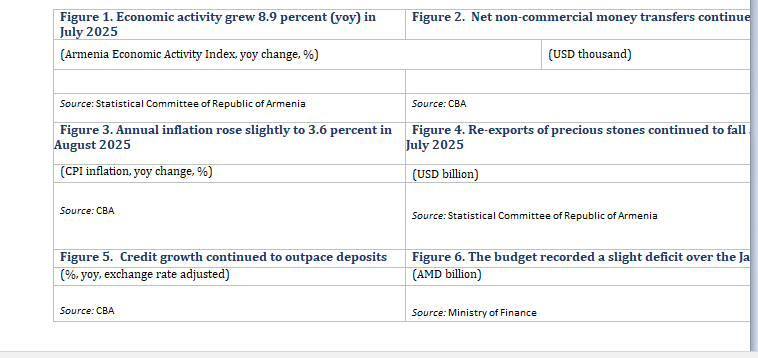

In July, the budget recorded a deficit of 0.2 percent of annual projected GDP. Tax revenues (including mortgage-related income tax) grew 18.1 percent (yoy) in nominal terms, driven by higher VAT collection (up 20.7 percent, yoy); income taxes (up 14 percent, yoy); and profit taxes (up 46.7 percent, yoy). Turnover tax rates were increased, boosting collection by 29 percent (yoy).

Total expenditures contracted 4.8 percent (yoy).

This was due to a 42.7 percent (yoy) fall in capital expenditure, driven by a 39.1 percent (yoy) fall in defense expenditure. Notably, expenditure on education grew 19.7 percent (yoy), driven by school construction and rehabilitation, as planned in the Government’s Five-Year Program (2021–2026). Current expenditure increased 4.7 percent (yoy), mainly driven by subsidies (up 21.3 percent, yoy).

The cumulative deficit over the January-July period reached 0.6 percent of the annual projected GDP.

World Bank Armenia