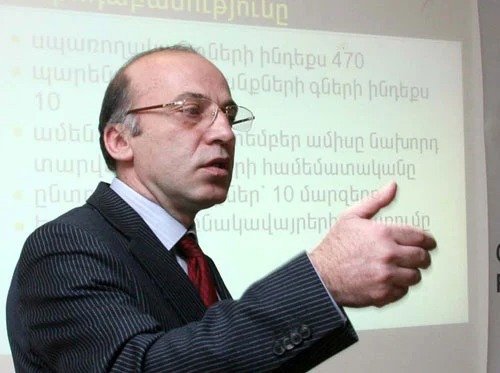

Economist Tatul Manaseryan considers predictable what is currently going on with the post-Soviet countries’ currencies: a sharp and radical instability. He considers one of the reasons the fact that although a quarter of a century has elapsed after the collapse of the Soviet Union, anyway, these countries are unable to adapt neither to the regional developments nor to global economic trends. “The post-Soviet countries’ GDP and export structures are not diversified enough. Even the geography of import is not subjected to sufficient diversification which means that there is a certain dependence on individual branches which provides a one-sided development for the economy,” said the economist in an interview with Aravot.am, noting that the dependence on export and import is quite great, particularly when it comes to foodstuff which is also a serious threat in terms of economic security.

Since 2014, the Russian ruble and the Belarusian currency depreciated by around 55 percent, now the depreciation reached already 75 percent. But the rapid devaluation was the Azerbaijan manat. As estimated by the economist, the manat hit the record by one hundred percent drop per year and caused panic in Azerbaijan. Generally, all post-Soviet countries were unable to avoid the drop of currency, to the point, by a two-digit number. Economically, it is called a “hyperinflation” which not only in the economics but also in the social sphere causes problems. On this background, however, in 2015, the Armenian dram recorded quite a stable position.

It is noteworthy that in the end of 2014, the Armenian dram was also under threat of devaluation at the exchange offices, there was panic among the population as the dram devaluation was also leading to a high inflation. Some business entities made such an attempt. To our question at what expense the government, in particular, the Central Bank responsible for the monetary policy, was able to stabilize the local currency situation, Tatul Manaseryan highlighted the increase in the mandatory reserve rate for the foreign currency liabilities. “It cause some upset in the banking system, some of them considered it unacceptable and unnecessary, saying that it could lead to economic consequences, but the experience showed that as it so as the increase in re-financing rates restrained the inflationary trends, by also easing the tension in the economy,” said our interlocutor reminding that the international institutions have made quite negative forecasts for the last year and on this background, complexity arose in terms of investments. “But this was the case when the stability of the financial market also reflected on the stability of the consumer market. There was no panic and the consumers seemed to be secure from shocks.”

As a reason for activation, the economist also considers the decrease of interest rates in the pawns, the involvement of long-term funds by the banks and the existence of almost the zero interest rate of reserve for it. “On this background, if you take the ups and downs of the last two months of 2014 and the solutions of the first quarter of 2015, the statistic date of the second quarter show that the inflation has become more manageable. That is what is very important for us, the consumers.”

Read also

In the end of 2015, the economist states that the inflation in December, which is an active period of holiday and trade, was quite low. Here, the favorable agricultural year (the abundance of fruits and vegetables) played a role, despite all negative predictions, some diversification (the geography of export of agricultural products) also increased. At the same time, our economy is greatly dependent on remittances, which were reduced by 40% causing a decline in purchasing power. The economist, however, states that the monetary policy has adequately responded to it, also registering a significant improvement by the overall external balance.

Anyway, now Tatul Manaseryan considers more important whether we will be able to realize this advantage – the stability of the local currency, which provides major macro-economic opportunities. But this is not the only central bank’s problem, “It is necessary to have first attacking and flexible economic policy. Armenia is now getting one more opportunity, the talks with the EU are resumed and I want to believe that this will put an end to the “either…or” which is very unacceptable for us, which was imposed to Armenia since 2013. If we can make good use of the opportunities provided, we will benefit. I think that the best resolution would be as follows: Armenia can import raw materials and energy carriers from the depreciated currency post-Soviet countries and develop local processing production, we can record substantial benefits. It seems there is such an agreement with Russia, there is an intention to buy gas with Russian rubles, which would not be a great loss for Russia but a great benefit for Armenia.”

Nelly GRIGORYAN