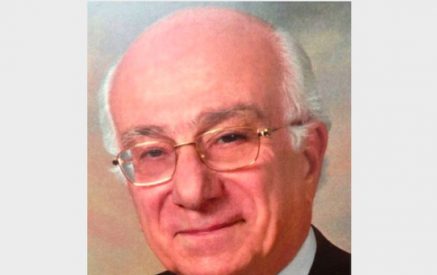

Economist Vilen Khachatryan considers it wrong that the unit weight of construction loans boosting the production, agriculture and economy in our loan portfolio are not so big.

Last year, in late December and early January of this year, after the foreign exchange crisis in our country, for several months, the Armenian banks can be said have entered a closed regime. A number of banks have stopped giving loans, and the few banks that were providing loans were high by the interest rate and were in dollars. This situation occurred in the Armenian banks when the national currency depreciated while the dollar exchange rate rose sharply – reaching about 500 AMD from 410 AMD per dollar. Over the past one-two months, some banks resumed providing loans, but not with the previous rate. After the foreign currency crisis, the banks have slightly increased the loan rate, which was also confirmed in an interview with us by economist Vilen Khachatryan.

In response to the question of “Aravot”, Mr. Khachatryan said that usually the foreign currency crises are followed by the banking crisis. “Our banks encounters this kind of risk and began, so to speak, reviewing their policy for a certain period of time to understand what is expected in the economy so that to start the loan process again. However, this led to the suspension of the loan process.” According to the data of the economist, according to the data of the first quarter of this year, the loans have decreased by approximately 95-100 billion by making 2 trillion 90 billion.

According to Mr. Khachatryan, 1.3 trillion in our banks’ loan portfolio is the foreign currency loans. “In other words, we give out a loan in dollars and euros, but we do not give out more in drams. The dram interest rate is high, and people prefer to take a loan in dollars at a low-interest rate rather than in a local currency loan. And the existing interest rates between dollar and dram loans made our banking system is be dollarized. The interest rates of these loans, truly, are low, but the dollar loans are quite negative for the economy in our country. When we have a depreciated local currency, people receive their wages in drams, most of their income is not in dollars, but they have taken loans in dollars, and a much larger portion of their money goes to the repayment of their loans.”

In Vilen Khachatryan’s words, the Armenian banks did not follow the example of the Russian banks and did not follow the path to transfer the dollar loans into a dram loans, as it was done in Russia. “Russia transferred most of its dollar loans into ruble loans, facilitating the burden of the dollar, because it is an additional burden on the dollar, people are reluctant to buy dollars, which caused the ruble depreciation, in other words, when the dollar demand is growing, similar problems arise. Our banking system did not cut down the dollar demand as such and maintained it. It could do it, with some losses, but the system would be healed.” Vilen Khachatryan compares the banking system to a sick man, who can be healed by some shots, albeit painful. “They preferred to leave the patient to slowly faint or be cured by himself or not, it is a question, but not to make the shot, so to speak, the interference, in other words, they did not choose the mechanism of healing the patient painfully and preferred to leave the patient at his own hope, letting it go by itself.”

According to the economist, our banking system has become the victim of its policy. “They say that it is stable, but are giving out loans of 18-20 percent, they show an average interest rate, which, of course, is low, but the average interest rate is provided for bigger amounts, and the small amounts are given out by a higher rate. Now, the banks are not issuing loans at a larger amount, they prefer giving 1000 dollar loan to 100 people rather than a 100 thousand dollar loan to a single person, as the latter is riskier, the interest rate of a 100 thousand is lower, and so on. And the consumer loans make approximately 450 billion of our loan, i.e. about 25% of our loan portfolio are the consumer loans while the consumer loans are provided only to the trade of imported goods. People are buying a phone, computer, and refrigerator, consequently, it turns out that we only boost our import by our consumer loans. We develop our consumer loan market for the sales of imported product. While the unit weight construction loans boosting the production, agriculture and economy is not so high.” In Vilen Khachatryan’s words, our loan portfolio can be named a “classic consumer loan portfolio.”

Lusine BUDAGHYAN,

“Aravot” daily