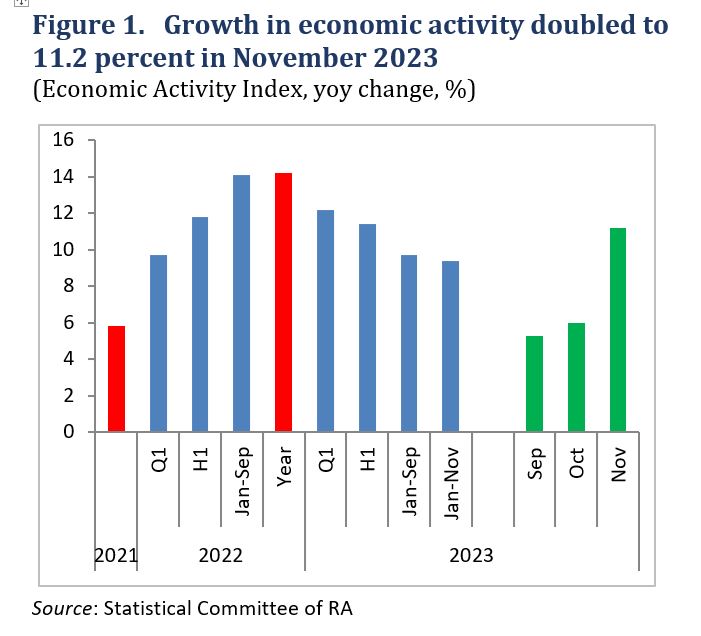

• Growth in economic activity surged to 11.2 percent in November 2023.

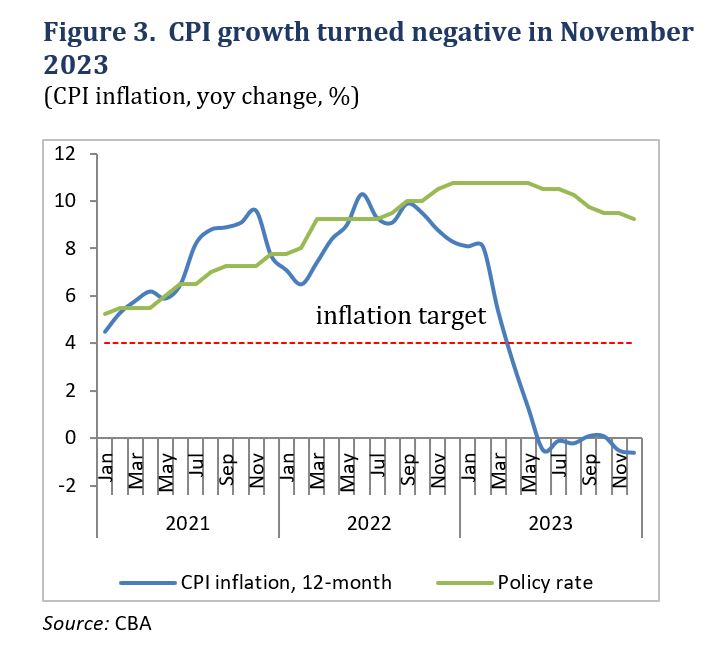

• Slight deflation was recorded in December 2023, driven by a fall in food prices.

• Export growth was exceptional in November 2023, driven by gold and jewelry.

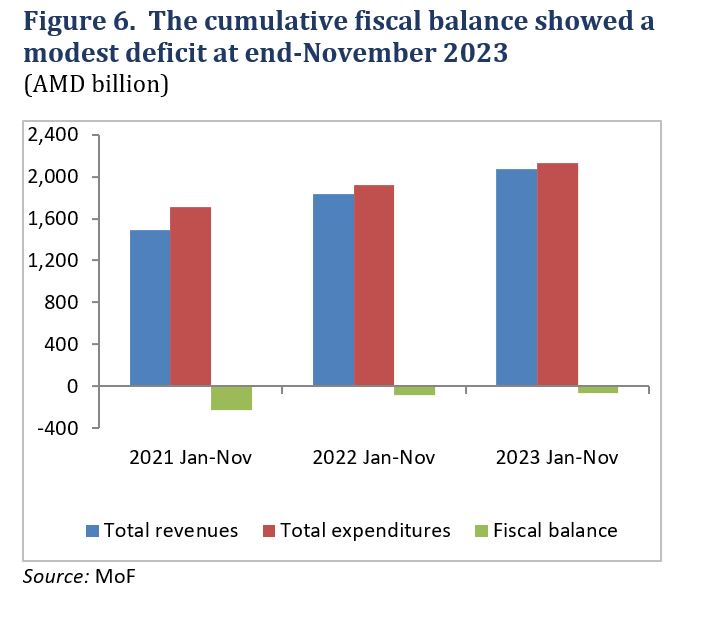

• The budget deficit was AMD 44 billion in November 2023, while the cumulative deficit remained lower than planned.

• Financial sector indicators have remained healthy.

Growth in economic activity accelerated to 11.2 percent (yoy, in real terms) in November 2023, compared to 6.2 percent (yoy) in October 2023 (Figure 1). Growth in industry increased from 0.6 percent in October to 24 percent in November, driven by 33 percent real growth in manufacturing output. This in turn was driven mostly by 13.7 times higher jewelry production (yoy) in November, which, by value, exceeded food production, traditionally the largest manufacturing group. High manufacturing growth in November was partly offset by challenges in mining sector production, affected by the temporary closure of the Sotk mine located on the Armenia-Azerbaijan border. Trade growth also rose, from 26 percent (yoy) in October to 32 percent (yoy) in November, fueled by cash transfers provided by the Government to displaced people from Nagorno Karabakh (NK).

Construction growth slowed but remained in double digits at 11.4 percent (yoy) in November. At 2.4 percent (yoy), services (excluding trade) had the least growth; however, this was due to a high base growth of 31 percent in November. Economic activity index growth remained at 9.4 percent (yoy) over January-November 2023 and continued to exceed expectations.

Unemployment rose slightly in Q3 2023 (yoy) and labor force participation also increased. Unemployment was at 12 percent in Q3 2023, up from 11.6 percent in Q3 2022, due to a 2 percent increase in the labor force (net employed and unemployed). Labor force participation increased to 61.7 percent in Q3 2023 from 60.9 percent in Q3 2022.

Read also

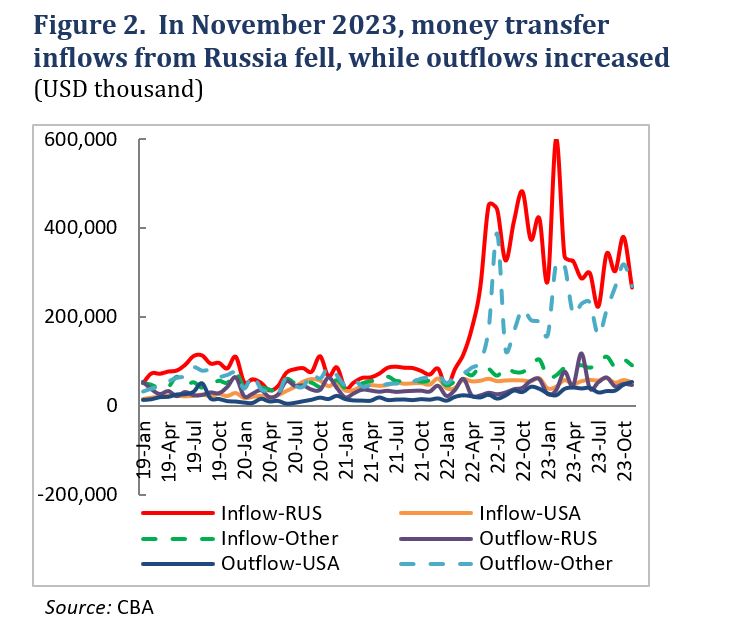

Net money transfers in November 2023 were down 82 percent from November 2022 and 68 percent compared to October 2023. Money transfer inflows contracted 21 percent (yoy) and outflows increased 26 percent (yoy). The contraction in inflows was mainly due to 29 percent fewer inflows from Russia (Figure 2). The main destinations for increased outflows were Monaco and the USA.

Prices registered 0.6 percent deflation in December 2023 (yoy). This brought average inflation down to 2 percent in 2023, a sharp fall from 8.6 percent in 2022. In response, in its December 12, 2023, meeting, the CBA Board cut the policy rate 25 basis points, to 9.25 percent. A 5 percent (yoy) fall in food prices was the main factor in deflation in December. However, prices of other commodity groups rose, with the highest increase recorded for alcohol and cigarettes, up 8.4 percent (yoy), reflecting increased excise tax on these products (Figure 3).

Export growth was exceptionally high, driven by a significant increase in gold and jewelry exports. Export of goods grew 86 percent (yoy) in November 2023, driven by a 7-fold increase in exports of precious and semi-precious stones. This increased the share of this group in total exports, up from 18 percent in November 2022 to 66 percent in November 2023. Within the group, exports of unwrought or semi- manufactured gold grew 12-fold (yoy), and jewelry and parts 17-fold (yoy). Textiles and footwear also grew 36 percent and 29 percent, respectively, while exports of other commodity groups mostly contracted. Imports of goods grew 25 percent (yoy), also driven by semi-manufactured gold imports. Cumulatively over January-November 2023, exports and imports grew 45 percent and 41 percent, respectively.

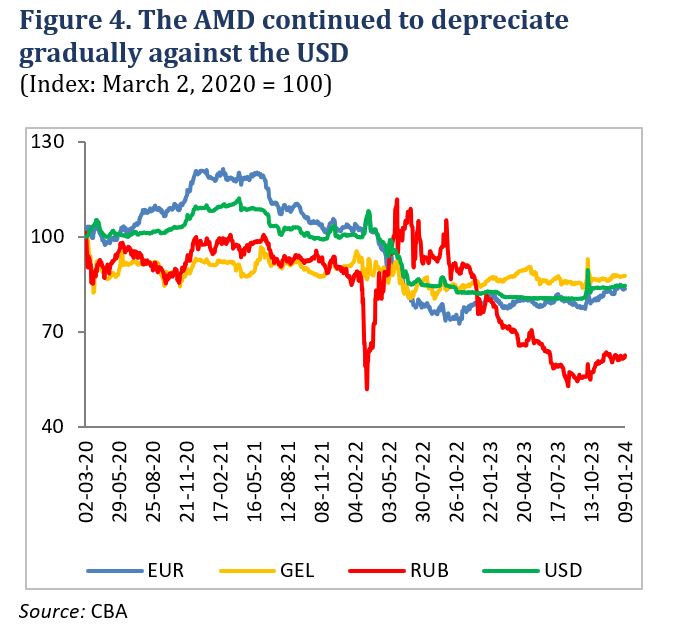

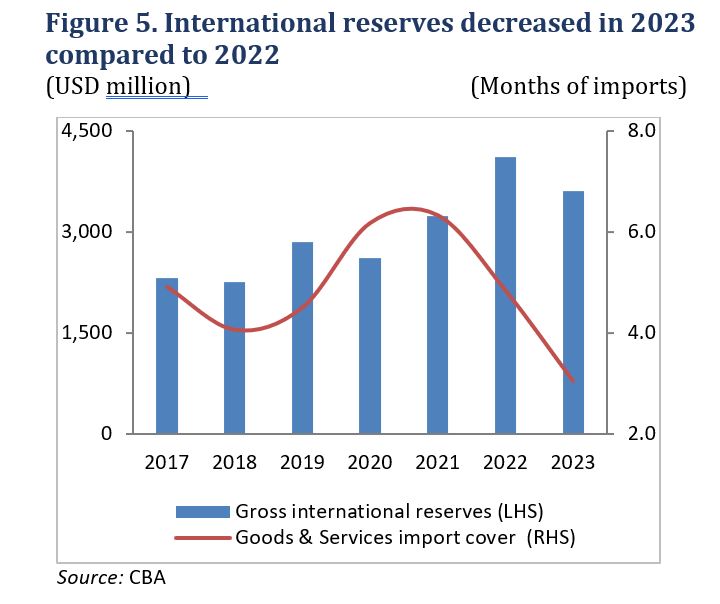

The AMD continued to depreciate gradually against the USD. As of January 9, 2024, the AMD/USD exchange rate stood at AMD 405.6, or 0.6 percent weaker compared to December 2023, and 2.7 percent weaker year-on-year (Figure 4). At year-end 2023, international reserves stood at USD 3.6 billion, equal to 3 months of import cover and USD 510 million lower compared to year-end 2022 reserves (Figure 5). This is partly due to the early buy-back of USD 188 million out of a USD 500 million Eurobond due March 2025, as well as to some delays in project-linked loans.

The budget recorded an AMD 44 billion deficit in November 2023. This brought the cumulative budget deficit through November to AMD 63 billion, or 0.7 percent of annual projected GDP. Tax revenue growth was modest at 5 percent (yoy) in November, driven by growth in income and excise taxes (up 15 percent and 16 percent, respectively), while VAT and profit tax collection declined 5.5 percent and 22 percent, respectively. Expenditure contracted 11 percent, driven by flat current expenditure and 29 percent lower capital expenditure, related to reduced spending on defense. However, social transfers and subsidies grew 4 percent (yoy) and 51 percent (yoy), respectively, reflecting cash transfers and other assistance to displaced NK people.

The financial system continued to grow in November 2023 and financial stability indicators remained sound. Loans and deposits grew 2.3 percent and 1.5 percent (mom), respectively. The capital adequacy ratio remained unchanged at 20.1 percent, and the ratio of non-performing loans to total loans remained below 3 percent. The return on assets, an indicator of the banking system’s profitability, stood at 3.3 percent.