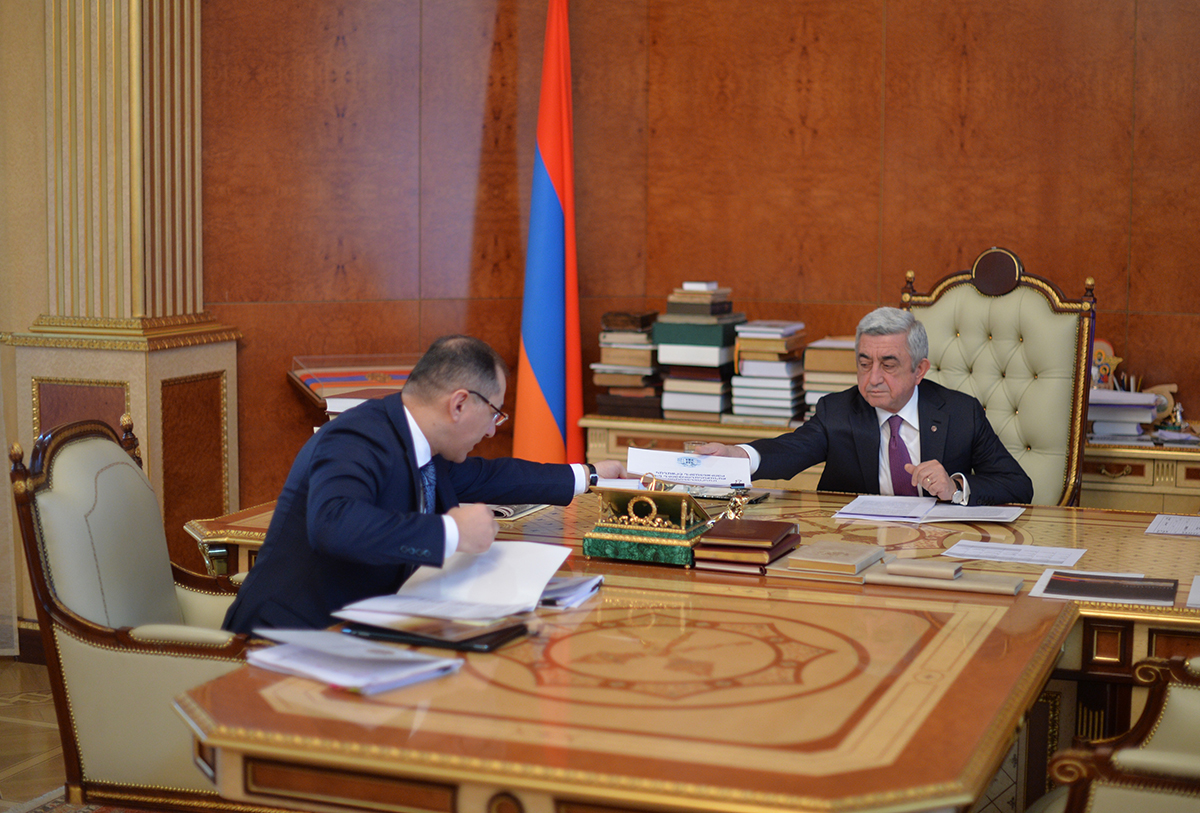

At a working meeting with the President of Armenia, Minister of Finance Vardan Aramyan reported back the results of FY2017 and introduced the work to be carried out in compliance with the fiscal policy-related instructions that the President issued during the 2018 State budget debate, including the key principles and approaches and the expected results. The Minister presented systemic solutions to increase public finance management efficiency.

Among key approaches, Vardan Aramyan pointed out the need to ensure macroeconomic stability, emphasizing that, to this end, fiscal consolidation was implemented in 2017 in order to firstly check and then slow down the growth of Government Debt/GDP ratio. As a result, the rate of growth of this indicator was reduced twice in 2017, and it is expected to decrease by one percentage point in 2018.

Minister Aramyan also reported on the work done to increase the economic growth potential and ensure long-term growth, noting that a relevant fiscal policy is being implemented, which will not hamper economic recovery and medium-term growth. This policy implied consolidating the role of own revenues through increased tax receipts and increasing the share of capital expenditure against recurrent spending in the structure of budget expenditures.

The Minister stressed that this approach allowed the government to abide by a more conservative behavior in terms of recurrent spending as stipulated by law and increase capital expenditure by about 40 billion drams, providing thereby the necessary prerequisites for future economic growth. Vardan Aramyan assured that the level of capital expenditure is expected to be higher than the fiscal year deficit in the near future.

The Minister also touched upon the steps undertaken to implement a business-friendly tax policy and, thereby, rule out the misinterpretations of that policy in the business environment. The Minister of Finance said that a balanced policy of forming own revenues is being implemented both in terms of curbing the black economy and improving the business environment.

The President told him to pay greater attention to the stability in fiscal policies and debt management in the current year, as well as to inform the business community on the trends of public debt over the medium term and the planned fiscal policy. As the President pointed out, it will instill confidence in investors due to the fact that the economic environment will be more perceptible and predictable.

Emphasizing that fiscal consolidation and the gradual reduction of the deficit are objectively imposed in terms of keeping the debt under control and ensuring macroeconomic stability, President Sargsyan made a point of keeping social issues in the spotlight, noting that the efforts aimed at maintaining the growth rates and increasing own revenues should be coupled with the use of various tools in order to step up the assistance provided to those vulnerable groups unable to generate income, and create appropriate conditions for vulnerable but active people.

Mindful of the imperative to implement an effective tax policy, the President highlighted the need for continued improvement of tax regulations in a way to make them easier to understand so that tax officials could not interpret them at their own discretion. At the same time, Serzh Sargsyan considered it necessary to take into account the fact that in order to ensure fiscal stability and predictable tax policy, the government should beware of making fundamental changes in tax legislation too frequently. According to the President, taxpayers should be convinced that the State will not make systemic changes in the tax field unless they are analyzed scrupulously and discussed in every detail.