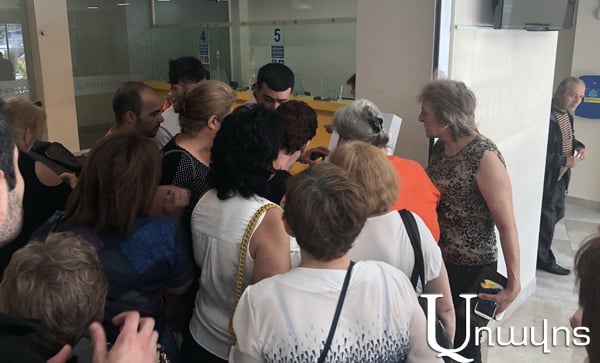

Perhaps there is no commercial bank in Armenia being free of queues at different parts of the day. The queues of the citizens in banks remind of the queues for bread and diesel oil of “dark and cold days”. People either take loans or pay the interests. Perhaps it is only underage and pensioners that do not have to pay the credit because they cannot receive one.

“The whole nation undergoes hard times paying the loans. They either take something with a credit or a loan for the house. There is no one depositing,” complain the loaners standing in the queue.

Meanwhile, pursuant to the data provided by Central Bank, the number of deposit accounts is higher than the number of the loaners. For example, the number of loaners made up 1 million and 264.108 in 2016, in 2017 they amounted to 1 million 397,397 and 1 million 533.345 in May 2018. Of course, this does not mean this is the precise number of loaners, it is possible that one person has loaned from two different banks. And the number of deposit accounts can also surprise. For example, they made up 3 million 672.007 in 2016, 3 million 710.333 in 2017, 3 million 824.118 in May 2018.

Similar to the loaners’ number, the numbers of deposit accounts in the banks do not speak of the fact that over 3 million citizens have deposited. This numbers of permanent residents do not exist in Armenia. Simply the same person can have deposit accounts in a few banks at the same time. And the overall volume of loans by Armenian drams in the Republic of Armenia exceeds the deposit. According to Central Bank, loan portfolio has increased in Armenia from 2016 to May 2018: it made up 2 billion 315 million and 719.000 drams in 2016, 2 billion 516 million and 837.000 drams in 2017, 2 billion 696 million and 583.000 on May 31, 2018.

The deposit portfolio in drams is lower than the portfolio of the loans. Moreover, it has increased in 2017, as compared to 2016, however, the deposit portfolio has decreased as of 31 May of the current year, as compared to 2017. For example, deposit portfolio in the Republic of Armenia made up 2 billion 177 million and 444.000 drams in 2016, in 2017 it has amounted to 2 billion 463 million and 734.000 drams, and 2 billion 408 million 305.000 drams in May 2018. That is, according to the aforementioned indicators, even though the deposit accounts exceed the number of the credits, there are more loaners than depositors in Armenia.

NELLY BABAYAN