- EBRD lifts forecast for 2021 to 4.2 per cent, up from 3.6 per cent in October forecast

- Industrial production and retail sales largely recovered after easing of Covid-19 restrictions

- Stimulus packages raised public debt by 11 percentage points of GDP on average

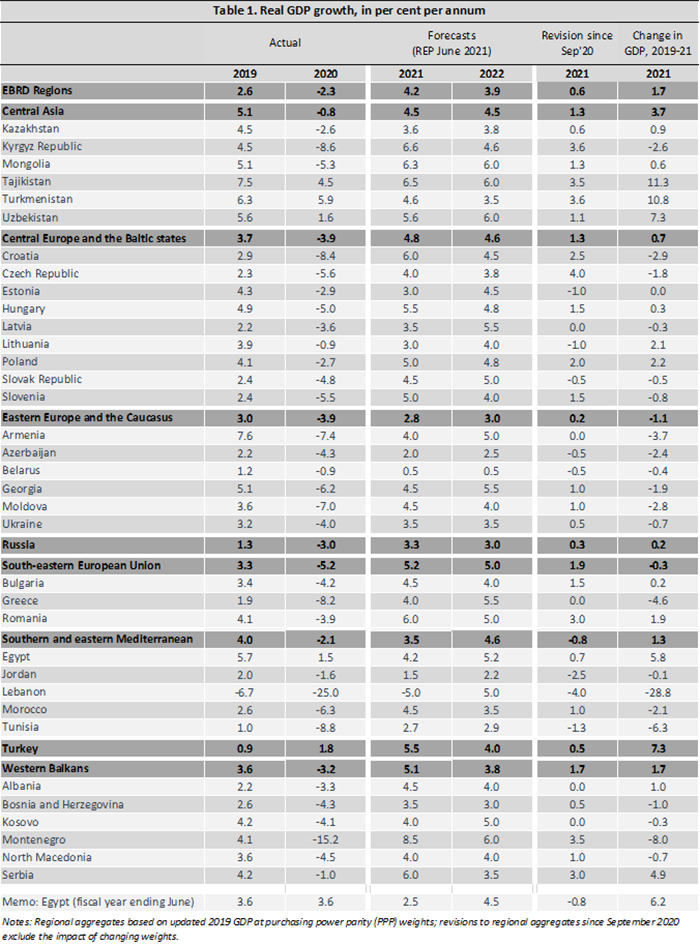

With growth of 4.2 per cent in 2021 the recovery of the emerging economies in eastern Europe, Central Asia and northern Africa is gathering pace following the Covid-19 pandemic, the European Bank for Reconstruction and Development (EBRD) says in its latest Regional Economic Prospects report, published today.

This is an upward revision for 2021 from the 3.6 per cent the Bank forecast for the year in its previous report in September 2020. For 2022, the EBRD expects further solid expansion with 3.9 per cent growth. The contraction in output in 2020 was also milder than previously forecast (2.3 per cent rather than 3.9 per cent) following improvements in the overall economic environment late last year due to strong exports and fiscal support.

EBRD Chief Economist Beata Javorcik said: “Although the revised forecasts give reasons to be optimistic, huge uncertainty remains with regards to the path of the Covid-19 Delta variant which poses particularly large risks for countries that have made less progress on vaccinations and for economies highly reliant on international tourism. The picture for 2020 is diverse. While several countries in central Europe and the Baltic states performed well compared with many advanced European economies thanks to a strong rebound in exports of goods, economies heavily reliant on tourism were hard hit. And in countries afflicted by challenging economic circumstances prior to the pandemic, Covid-19 only compounded existing problems.”

The increasing rollout of vaccination programmes and improvements in the public health situation have allowed for a gradual withdrawal of social distancing measures and other restrictions. As a result, economies have restarted: Industrial production and retail sales have largely recovered and the average mobility of people in the regions where the Bank invests has mostly returned to pre-pandemic levels.

Higher commodity prices have boosted the revenues of commodity exporters and demand for manufacturing exports has been strong. Manufacturing exporters are gaining from a temporary shift away from services and towards manufacturing.

However, the outlook for international tourism remains highly uncertain and due to still widespread travel restrictions tourism-dependent economies continue to suffer. Meanwhile, foreign direct investment remains far below pre-crisis levels in most of the regions where the EBRD invests.

Higher commodity prices, increased demand for manufactured goods, currency depreciations and higher inflation in trading partner countries have pushed up inflation in the EBRD regions (by an average 0.8 percentage point relative to pre-pandemic levels), despite slack in the labour markets in many economies.

The headline numbers also hide significant differences in the impact of Covid-19 on individuals, with the young and those with lower levels of education and income particularly affected.

Furthermore, fiscal vulnerabilities have increased as large stimulus packages have boosted public debt in the EBRD regions by an average of 11 percentage points of GDP. In many economies, public debt is now at levels last seen during the transition recession of the early 1990s and may rise further. While bankruptcies have so far remained contained owing to extensive policy support, vulnerabilities may surface when government support measures are withdrawn.

Professor Javorcik added: “The EBRD countries of operations have made progress on narrowing the digital divide over the past year, although it is still the case that richer households, more educated individuals and those residing in urban areas are more likely to make purchases online. This pattern is stronger in poorer countries.”

While average borrowing costs remain low on average and interest payments stable, some countries have seen sharp increases in interest payments.

Forecasts are highly sensitive to the path of Covid-19 infections, assumptions as to government policies and the effectiveness of policy actions to limit persistent economic damage. Country-specific policy initiatives underpinning the recovery are further summarised in the EBRD’s Coronavirus response in 2021: Building Back Better.

Regional overview

In central Europe and the Baltic states, industrial production and manufacturing exports have rebounded and services are recovering. Output is expected to increase by 4.8 per cent in 2021 and 4.6 per cent in 2022, reflecting strong household consumption and investment and supported by European Union recovery funds.

In the south eastern European Union GDP is expected to grow by 5.2 per cent in 2021 and 5 per cent in 2022 as fiscal support and the prospects of substantial EU recovery funding in the coming years boost investor and consumer confidence. However, continued uncertainty about tourism weighs on the outlook.

In the Western Balkans, output is expected to grow by 5.1 per cent in 2021, reflecting strong growth in the year to date and sustained fiscal stimulus. However, continued uncertainty about travel restrictions is weighing on the outlook for tourism-dependent economies. Growth is forecast to moderate to 3.8 per cent in 2022.

In Russia output is seen growing by 3.3 per cent in 2021 and 3 per cent in 2022 as the easing of restrictions on activity underpins a recovery in domestic demand. The boost from higher commodity prices is expected to be partly offset by a more neutral fiscal and monetary policy stance.

In eastern Europe and the Caucasus, economies are expected to grow by 2.8 per cent in 2021 and 3 per cent in 2022 as lockdowns are lifted and demand for exports remains strong. Higher commodity prices support the recovery in commodity exporting economies.

In Central Asia, the outlook has also been revised up, although the recovery is far from uniform. The region is expected to grow by 4.5 per cent in 2021 and 2022, reflecting higher commodity prices, which benefit commodity exporters, as well as recovering remittances.

Turkey’s economy is forecast to grow by 5.5 per cent in 2021 and 4 per cent in 2022, driven by exports, while domestic demand remains constrained by the impact of continuing containment measures and the weaker financial situation of households.

In the southern and eastern Mediterranean (SEMED) region, output is expected to grow by 3.5 per cent in 2021, though the speed of recovery varies across economies reflecting the slow recovery in tourism, mounting fiscal pressures and political uncertainty. Growth is predicted to increase to 4.6 per cent in 2022, supported by structural reforms, recovering foreign investment and trade flows.

The EBRD is a multilateral bank that promotes the development of the private sector and entrepreneurial initiative in 38 economies across three continents. The Bank is owned by 69 countries as well as the EU and the EIB. EBRD investments are aimed at making the economies in its regions

European Bank for Reconstruction and Development (EBRD)