Administrative responsibility by the legislative initiative of the Government will not be enforced for not paying in the established term the taxes, the duties and the compulsory payments, as well as the common procedure issues will be regulated, the provisions of the implementation of the procedures in electronic way established by law will be spread towards all cases subject to the examination of the tax body, but as a result of editing the provision of the law entering into force up to the introduction of the electronic system, as well as in cases of impossibility of technical operation of the electronic system, the administrative proceedings will be carried out on paper, as a result of which, the relations regarding the notification through the personal office within the framework of the administrative legal offence proceedings of the taxpayer’s officials established by will be regulated among other issues.

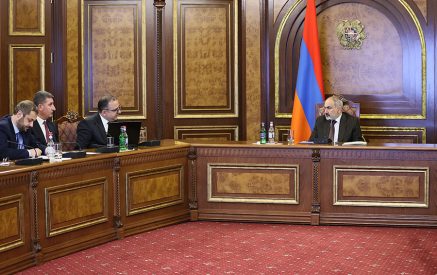

The RA Deputy Chairman of the State Revenue Committee (SRC) Artur Manukyan said at December 11 regular sitting, presenting for debate the package of drafts on Amending the Code of the Republic of Armenia on Administrative Offences and on Making Amendments and Addendum to the RA Code on Administrative Offences.

As he assured, the problem is that the initiation of the administrative proceedings by the Code is a double administration by the tax body, which is not effective, taking as a basis the practice of using the responsibility established by the Article 170.3 Article of the Code.

It was noted that in case of not fulfilling the tax obligations within the specified time limits by the prevention of the tax non-paying cases and the taxpayers, and the tax body has appropriate administrative toolkit established by the RA Tax Code (Implementation of levying non-paid tax obligations, as well as the administrative proceedings of the taxpayer’s property ban), by which the fulfillment of relevant obligations by the taxpayers and the restoration of the state budget revenues.

Read also

It was also noted that liability is provided by the RA Tax Code and on the payments in case of not paying within the time limits or not paying late from those time limits, payment of penalty designed for overdue every day.

Taking as a basis the abovementioned, it is proposed to recognize the Article 170.3 of the Code recognized.

The rapporteur also answered the deputies’ question, which referred to the problems of the sphere.

The co-rapporteur, the deputy Hovik Aghazaryan presented the endorsement of the NA Standing (Head) Committee on Economic Affairs.

National Assembly of the Republic of Armenia