Growth in economic activity rose to 6 percent (yoy, in real terms) in October, compared to 5.3 percent

(yoy) in September in Armenia. This was driven by an uptick in trade and a rebound in manufacturing

activities. Retail trade growth rose from 10.6 percent (yoy) in September to 17.1 percent (yoy) in October.

Industrial output grew by 0.6 percent (yoy) in October, after falling by 4.3 percent (yoy) in September, the World Bank said in a monthly update on Armenia.

Manufacturing, in decline since July, grew by one percent (yoy) in October; most of this increase is

explained by a rebound in food production. However, shrinkage in mining (down 6.1 percent, yoy) lowered overall growth in industrial output. Construction growth eased, although it remained in double-digits, at 13.6 percent (yoy).

Growth in services (excluding trade), the main driver of growth, decelerated further to 2.1 percent (yoy). This was driven by contraction in financial and insurance services (14 percent, yoy) and deceleration in transport services (to 1 percent, yoy). Overall, growth in the economic activity index remained at 9.2 percent (yoy) over January-October.

The unemployment rate fell, supported by strong economic growth. The falling unemployment trend,

Read also

which started in 2021, continued through 2023. The unemployment rate reached 11.7 percent in Q2 2023,

down from 13 percent in Q2 2022. Net money transfers continued to fall, contracting by 62 percent (yoy) in October. Money transfer inflows continued to shrink (at a rate

of 12 percent, yoy) and outflows increased by 44 percent (yoy).

Net inflows from Russia, the main source of inflows, contracted by 25 percent due to 21 percent lower

inflows from, and 21 percent higher outflows to, Russia. Prices recorded 0.5 percent deflation in November (yoy). A 4.4 percent fall in food prices (yoy) was the main contributor to deflation. Prices in other commodity groups rose, the highest being alcoholic beverages and cigarettes, up 8.3 percent (yoy) due to an increase in excise tax rates. This brought average inflation to 2.2 percent, further below the 4 percent target.

Both export and import growth rates (yoy) rose in October compared to September, with imports growing faster than exports. Imports of goods grew by 22.4 percent (yoy) in October, driven by an increase in imports of precious stones (up 188 percent, yoy), textiles (up 66 percent, yoy), and machinery (up 26 percent, yoy). Most other imports contracted compared to October 2022. Exports grew by 14 percent (yoy) in October, with the highest contributor being machinery and precious stones (up 70 percent and 52 percent, yoy, respectively), including re-exports. Over the January–October period, exports and imports grew cumulatively by 38.5 percent and 42.9 percent, respectively. If reexports of precious stones and machinery are excluded, export and import growth in 2023 to date reached 10 percent and 20 percent, respectively.

The AMD remained mostly stable in November. As of December 4, the AMD/USD exchange rate stood at AMD 403.1, which is 1.8 percent weaker (yoy) In November, international reserves decreased by USD 177 million, pushing import coverage down to 3.1 months. In October the Government bought back USD 188 million of a USD 500 million Eurobond due in March 2025.

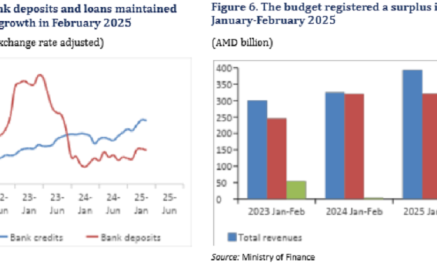

The budget recorded a high deficit of AMD 93.6 billion in October, bringing the cumulative budget surplus at end September to a deficit of AMD 19 billion for January-October 2023. Tax revenues grew

by 15 percent (yoy) in October, driven mostly by an increase in VAT (up 28 percent, yoy) due to higher

consumption. Expenditure grew more rapidly, by 24 percent (yoy), mostly due to a 24 percent increase in

current expenditure. This was driven by 32 percent higher social spending and 60 percent higher subsidies,

reflecting cash transfers and other assistance to Nagorno-Karabakh displaced people.

Capital expenditure also rose by 24.3 percent (yoy). In the first 10 months of 2023, the budget showed an AMD 19 billion deficit, or 0.21 percent of annual projected GDP, considerably below the annual plan of 3 percent of GDP.

The financial system remained solid with loans and deposits growing at 2 percent and 2.9 percent (mom), respectively. Whereas the increase in loans was due mostly to an increase in AMD-denominated loans, deposits grew due mostly to FX-denominated deposit increases. In October, the capital adequacy ratio

fell marginally by 0.5 percentage points (mom), to 20.1 percent (above the 12 percent requirement), and the ratio of non-performing loans to total loans fell slightly to 2.6 percent. However, banking system profitability rose as the return on assets picked up from 3.2 percent in September to 3.4 percent in October.